R⋆STARS Training Manual

R⋆STARS Training Manual R⋆STARS Training Manual

R⋆STARS Training Manual

Chapter #2

Classification Structure Overview

The R⋆STARS Classification Structure

General Ledger Account Structure

Program and Organization Structures

Combining the R⋆STARS Structures

By far, the most complex topic in the R⋆STARS training program is the Classification Structure. It is a complex topic because Oregon's accounting needs are complex.

The State of Oregon tracks and reports on financial transactions at a variety of levels:

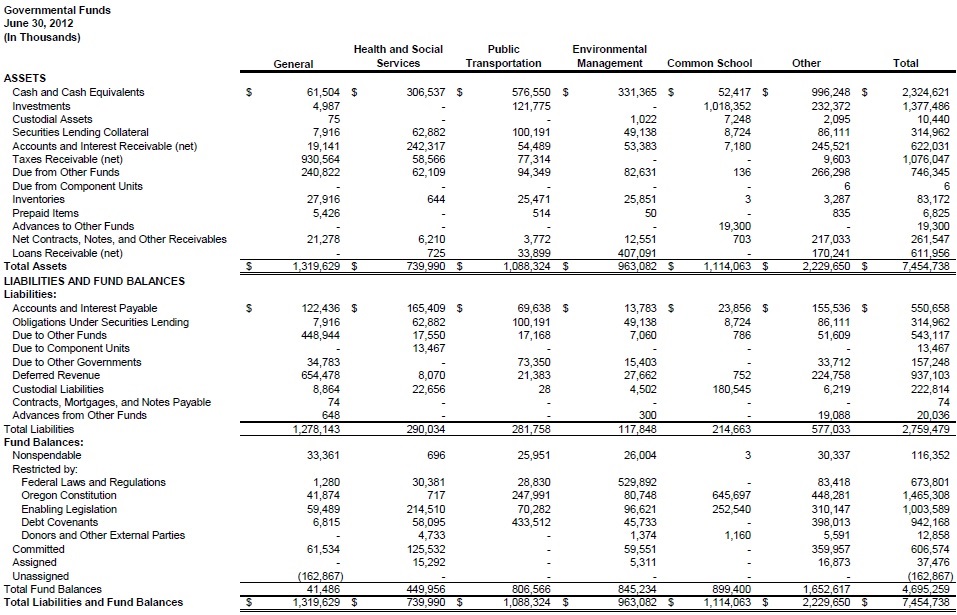

◾ At the highest level, all financial transactions must come together for Oregon’s Annual Comprehensive Financial Report (ACFR) as specified by the Governmental Accounting Standards Board (GASB).

◾ The federal government has numerous reporting requirements for states. Many Oregon state agencies accept federal funds and must be in compliance with federal reporting requirements.

◾ To ensure accountability to Oregon’s citizens and the state legislature, state government must be able to provide statewide, agency, and program level information.

◾ To manage Oregon’s resources efficiently, financial information must be gathered and organized in ways that are meaningful to individual agencies.

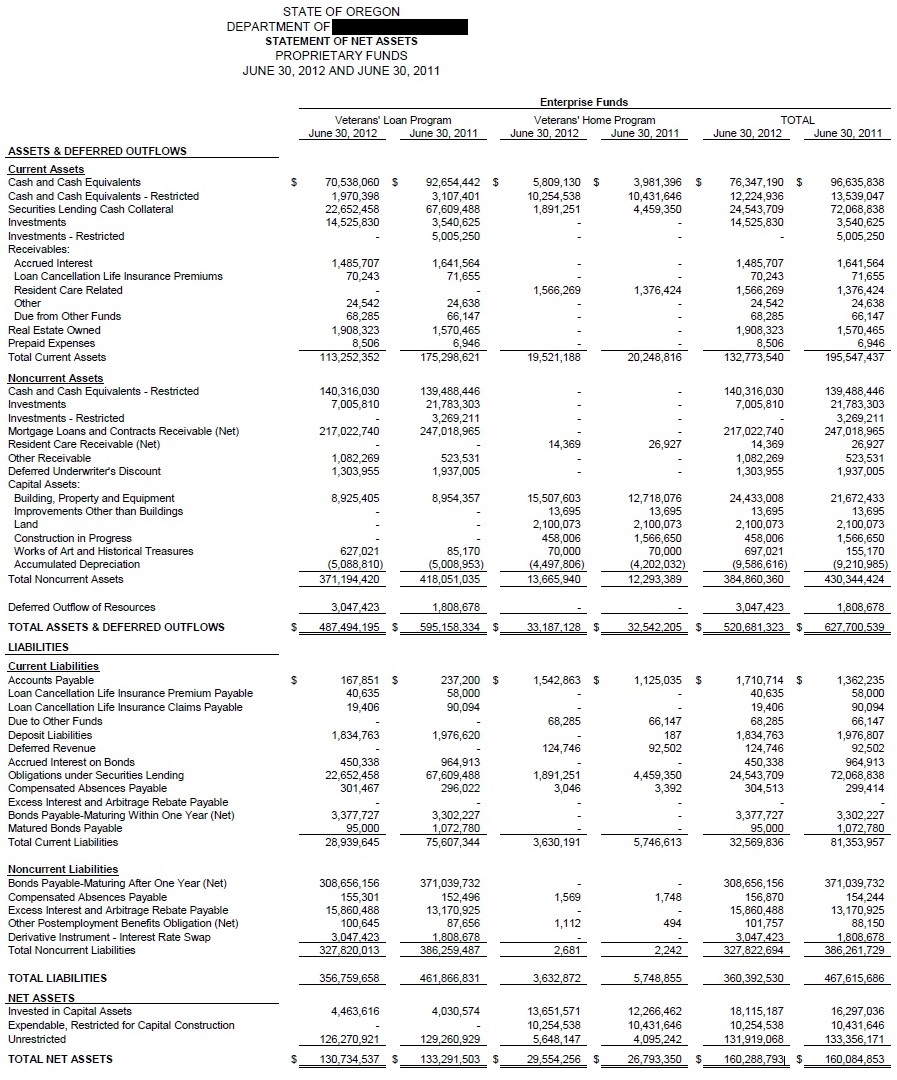

◾ Individual agencies must be able to produce monthly, quarterly, annual, and bi-annual financial statements that are in compliance with Generally Accepted Accounting Principles (GAAP) and GASB.

◾ For audit purposes, Oregon’s accounting system must record and store data at a very detailed level.

There are eight subsets of the R⋆STARS classification structure used in Oregon. These include Fund, General Ledger, Object, Appropriation, Program, Organization, Project, and Grant. These subsets are used to organize data and produce the necessary reports, online inquiries, and audit trail.

Structure |

Description | |

Fund | The Fund Structure is primarily concerned with accounting, budgeting, cash management, and managerial reporting requirements for Oregon. It plays an important role in the ACFR. | |

General Ledger | Like the Fund Structure, the General Ledger (GL) structure is integral to the ACFR. GL accounts include cash, payables, and fund balances. | |

Object | The Object Structure is used for revenue, expenditure, and statistical tracking. Object codes are used to group transactions by sources of revenue and types of expenditures. For example, taxes may be a source of revenue; personal services are a type of expenditure. The Object Structure is important for preparing the Combined Statement of Revenue, Expenditure and Changes in Fund Balance. It is also important in tracking appropriations and budgets. | |

Appropriation | The Appropriation Structure is used to monitor budgets for the Legislature and agencies. The Budget and Management Division of DAS (BAM) controls the statewide structure for appropriations. | |

Program | This is an agency defined structure that is used to account for agency activities and track appropriations on a more detailed level. It ties the accounting transactions to the Oregon Budget Information Tracking System (ORBITS) with the ORBITS cross reference number. It impacts transaction entry, resource management, online inquiry, and reporting. | |

Organization | Similar to the Program Structure, the Organization Structure allows agencies to create an alternative structure for looking at and managing resources. | |

Project And Grants |

These two structures provide additional tracking resources for agencies involved in projects and grants. |

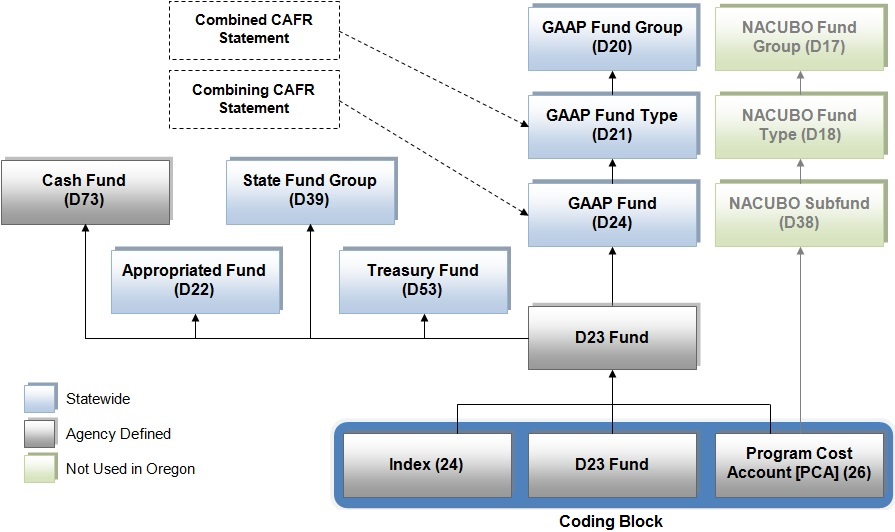

A fund is a self-balancing set of accounts designed for accounting and budgeting purposes. The Fund Structure in R⋆STARS accommodates numerous types of funds. These include:

Structure |

Description | ||

Treasury Funds | Treasury Funds can be statewide or agency specific accounts that are used to track the state’s banking activity. They consist of receipted and suspense accounts, such as General Fund and State Highway Fund. The funds are defined on the D53 Title Profile, TABLE ID: TRES. | ||

Budgetary Funds | Oregon Legislature requires that agencies report on revenue and expenditure activity for their appropriations. BAM summarizes agency specific activity by fund type. In R⋆STARS, we track this activity through the appropriated fund structure. The structure is defined on the D22 Appropriated Fund and D39 State Fund Group profiles. Examples of these funds include General Fund, Other Funds Limited, and Federal Funds. | ||

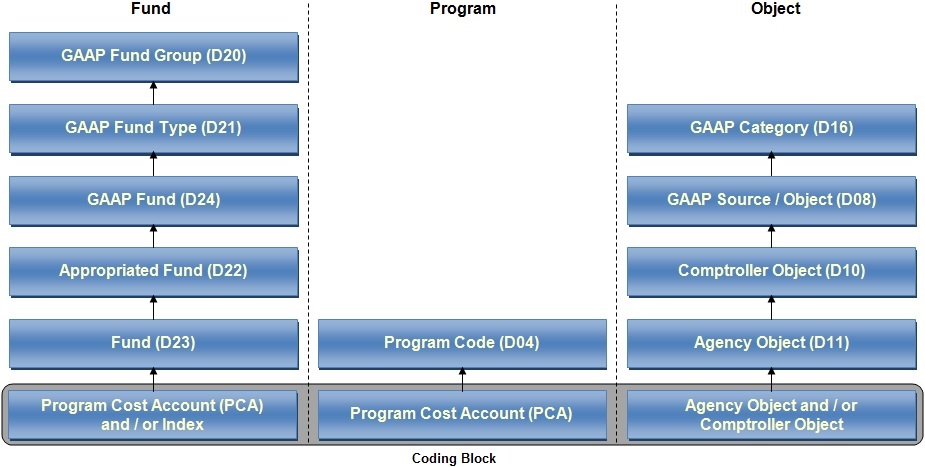

Accounting Funds | Agencies use the General Ledger data to produce financial statements. In addition, The statewide Accounting and Reporting Section of DAS (SARS) produces the ACFR. In R⋆STARS, these fund types are defined on the D24 GAAP Fund, D21 GAAP Fund Type and D20 GAAP Fund Group profiles. Examples of the D20 (highest level) funds include Governmental, Proprietary, and Fiduciary. | ||

NACUBO Funds | These funds pertain only to colleges and universities. They track fund activity and balances according to the National Association of College and University Business Officers (NACUBO) standards. At this time Oregon is not using this fund structure. Should Oregon decide to use them in the future, we would create the structure on the D38 NACUBO Sub Fund, D18 NACUBO Fund, and D17 NACUBO Fund Group profiles. | ||

Fund | Agencies submit requests to SFMS for approval and establishment of the agency fund structure on D23 Fund Profiles. D23 Funds define the relationship of the agency’s structure to the other R⋆STARS funds. SFMS ensures appropriate legislation exists prior to establishing new D23 Funds. | ||

Cash Fund | Agencies may want to pool cash for several different funds. They can do so by creating a Cash Fund on the D73 Cash Fund Profile. Several D23 Funds may point to one Cash Fund (several Cash Funds may point to a single Treasury Fund). Cash Funds do not meet the GAAP definition of a fund. |

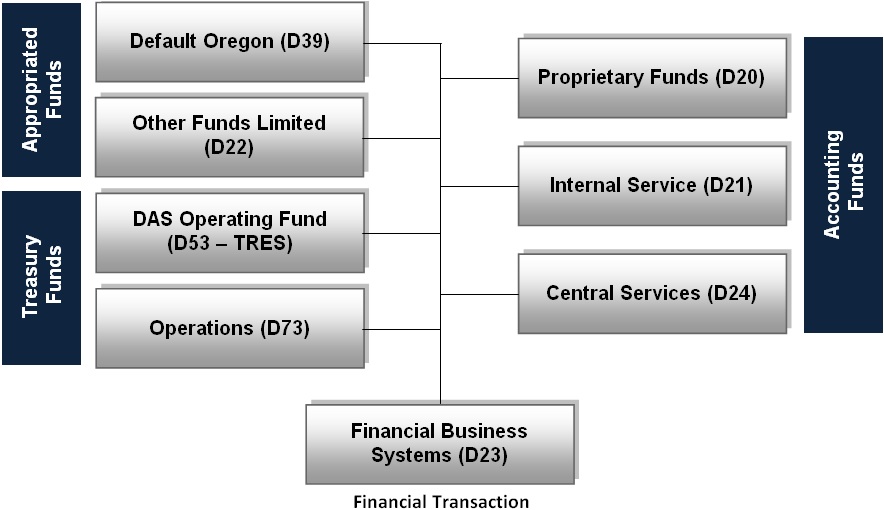

In the Fund Structure example above, a financial transaction is entered to the Financial Business Systems Fund. The transaction will be posted or “rolled up” to the “higher levels.” This allows Oregon to produce statewide reports like the ACFR.

Note that this example has three major components, they are:

Treasury Funds

Appropriated Funds

GAAP Accounting Funds

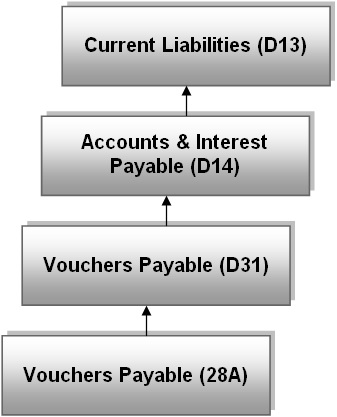

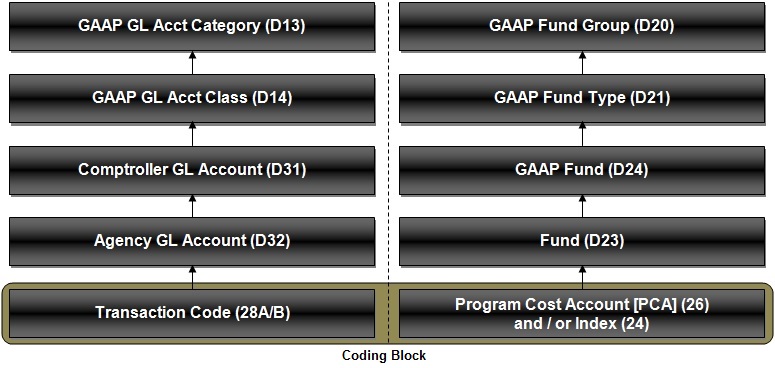

The General Ledger Account Structure is used to define the Chart of Accounts. In other words, it is used to establish the accounts for the Balance Sheet and Operating Statement. In addition, R⋆STARS provides the ability to use the GL structure for statistical tracking. Like the Fund Structure, the General Ledger Account Structure has the capability to imply the Statewide General Ledger Account Structure from agency defined accounts.

The agency defined subsidiary accounts are defined on the D32 Agency General Ledger Account Profile. The Statewide General Ledger Accounts are defined on the D31 Comptroller General Ledger Account Profile.

In the accounting transaction, the transaction code designates the General Ledger accounts to which the transaction will post. The relationships are created on the 28A Transaction Code Decision Profile.

S28A UC: 01 STATE OF OREGON 08/05/13 03:25 PM |

LINK TO: TRANSACTION CODE DECISION PROFILE PROD |

|

TRAN CODE: 225 TITLE: VOUCHER PAYABLE - ENCUMBERED |

GENERAL LEDGER DR-1: 3501 CR-1: 1211 DR-2: CR-2: |

POSTING DR-3: CR-3: DR-4: 3011 CR-4: 2735 |

TRANS DOCD DUDT I SVDT CDOC I RDOC I MOD I AGCY R IDX PCA COBJ R |

EDIT AOBJ RVRS N PDT R CI N 1099 R WARR INVC VNUM R VNAM R VADD R |

INDS: DMETH R APN# R FUND R GLA N AGL N GRNT SUBG PROJ MULT G38# N |

POST SEQ: 3 REG NO: 2 WW IND: 1 D/I: D WAR CANCL TC: 385 PYTC: FUTMY: Y |

GEN- TC: DT: ACCR TC: TR TC: INTERFACE IND: |

PAY LIQ TC: 380 PAY RED TC: 390 CUM POST IND: Y BAL TC: A/S DOC AMT: + |

A/S BT MATCH GLA DOC A/S BT MATCH GLA DOC |

DF: + 03 M 8 2 + 04 M 8 2 |

FILE AP: - 18 + 17 |

POSTING AB: - 18 + 17 |

INDS: CC: |

GP: - 18 + 17 |

PJ: - 18 + 17 |

AGY GL: STATUS CODE: A |

EFF START DATE: 06011990 EFF END DATE: LAST PROC DATE: 09022003 |

Z06 RECORD SUCCESSFULLY RECALLED |

|

F1-HELP F3-DEL F5-NEXT F-28B F9-INT F10-SAVE F11-SAVE/CLEAR ENT-INQ CLEAR-EXIT |

General Ledger debits and credits are usually shown in pairs. Each transaction code can have up to four sets of debits and credits. Usually, the DR-4 and CR-4 record the liquidation of a previous transaction, such as an encumbrance.

In the example above, a transaction was entered with Transaction Code 222, Voucher Payable – Not Encumbered. This transaction will generate a warrant to pay for office supplies. The system will use the coding to imply higher level postings.

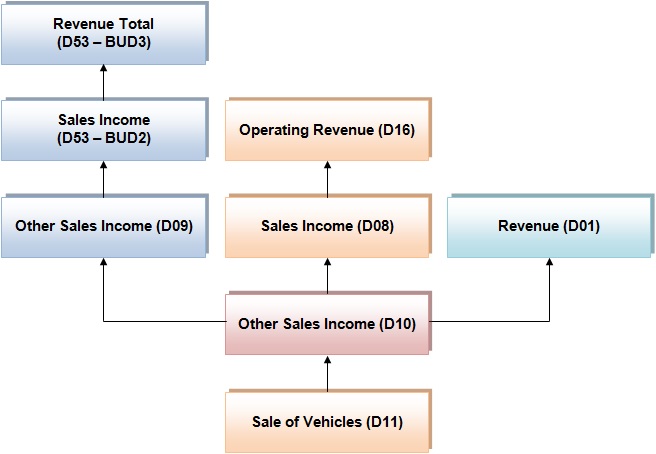

The Object Structure is used to identify the source of revenues and the type of expenditures. Similar to the other structures, there are state defined objects, referred to as Comptroller Objects (COBJ – D10 Comptroller Object Profile) and there are agency defined objects, referred to as Agency Objects (AOBJ – D11 Agency Object Profile). Agencies wanting greater detail can define Agency Objects. Examples of Revenue Comptroller Objects include park user fees, motor fuel taxes, and personal income taxes. Examples of Expenditure Comptroller Objects includes office supplies, instate meals and lodging, and office furniture and fixtures.

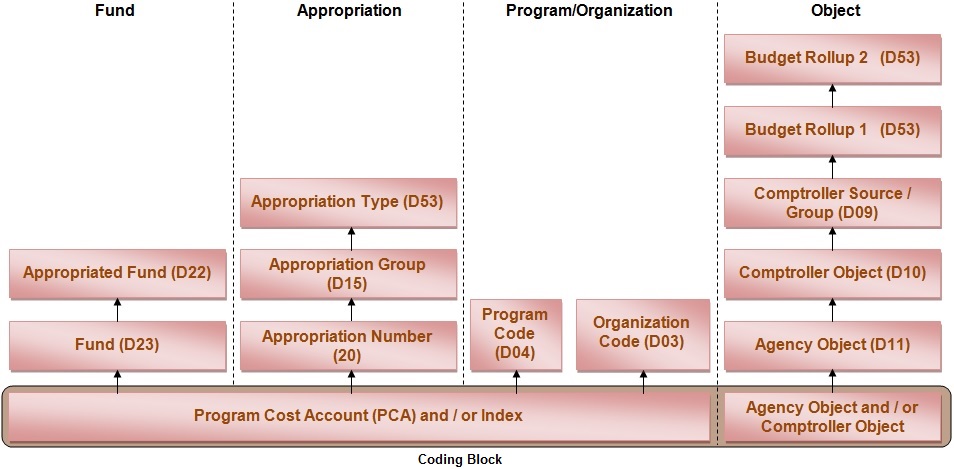

As with other aspects of the classification structure, R⋆STARS provides the ability to roll-up or imply more general categories. Agency Objects roll-up to the more general Comptroller Objects. In addition, R⋆STARS provides roll-ups specific to budget, (D09 Comptroller Source Group and D53 Budget Rollup 1 and Rollup 2), General Ledger statements, (D08 GAAP Source Object and D16 GAAP Category), and appropriations (D01 Object).

The objects are designated in the accounting transaction by the Comptroller or Agency Object Code.

In this example, the motor pool sold a vehicle. The agency decided to track expenditures in greater detail than the Comptroller Objects and established Agency Objects on the D11 profile.

Appropriation numbers are used to control Oregon’s appropriations and limitations from the Legislature. Appropriation numbers in SFMA provide budgetary control similar to the appropriations and limitations in the previous Control Accounting System.

BAM maintains the appropriation structure. Agencies, however, will provide input on the following elements:

Appropriation Number |

Legal Authority |

Like the other structures, the Appropriation Structure has the capability to be “looked up” and to “look up.” The profiles that can define the appropriation structure include the 20 Appropriation Number Profile, D15 Appropriation Group Profile and D53 profile (Table ID: APTY). Oregon is currently not using the D53 profile for Appropriation Structure definition.

In the accounting transaction, the appropriation can be looked up by the PCA or index.

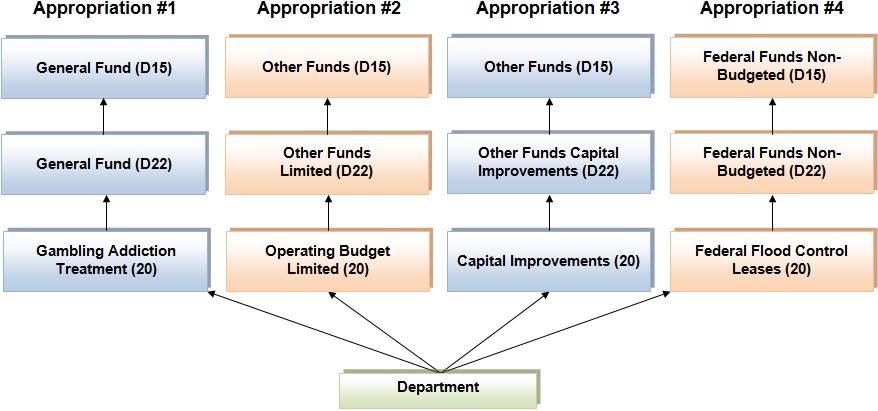

In this example, the agency has four separate appropriations. Each of these appropriations is defined on the 20 profile. The system can then imply the more general statewide categories for these appropriations.

Although they are separate structures, the Program Structure and Organization Structure are related and can be discussed together. These two structures represent two different ways of sorting agency financial information. Both structures have coding reduction capabilities that imply an entire program or organization structure from one entered code, thus reducing the data entry required to code atransaction. See Coding Reduction later in this chapter.

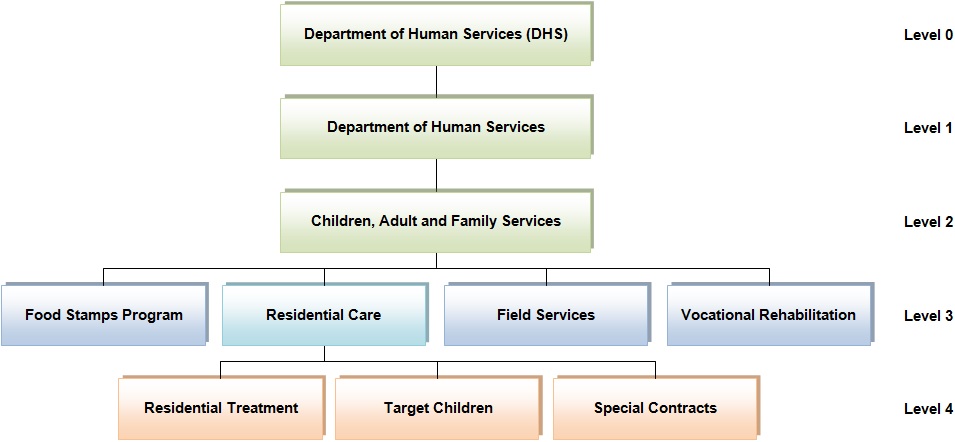

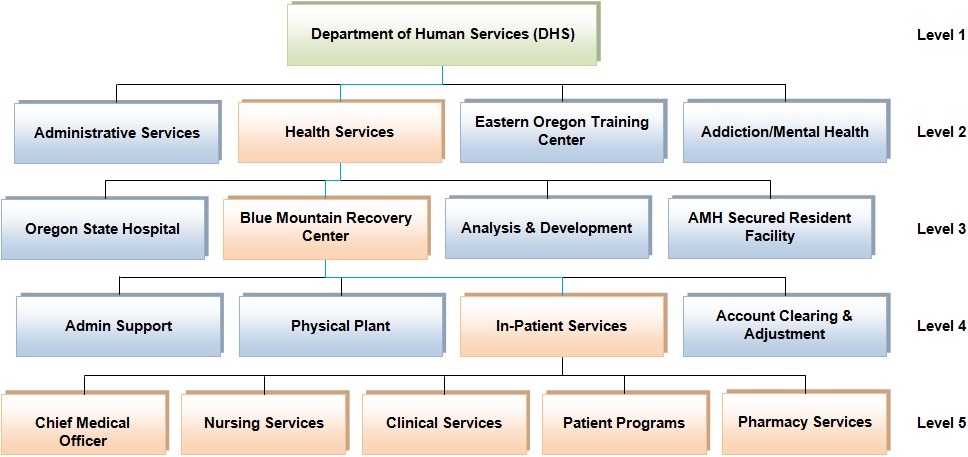

The Program Structure in R⋆STARS allows agencies to track financial activity. It is generally related to the agency’s goals and objectives and reflects what the agency does. The program structure may be as many as nine levels. Oregon has elected to use the top two levels to track appropriations. Thus, agencies can track their own budgets in levels three through nine. Agencies set up program structures on the D04 Program Code Profile in coordination with BAM Statewide Audit and Budget Reporting Section (SABRS).

The program structure is designated in the accounting transaction by the PCA (26 Program Cost Account Profile).

The Organization Structure is quite similar to the Program Structure. It gives agencies the capability to track activity based on how state agencies are physically organized. Agencies establish an organization structure on the D03 Organization Code Profile. The organization structure is designated in the accounting transaction by the index (24 Index Code Profile).

The Grant Structure is used to track budgets, revenues, expenditures, and statistics for a specific funding source, such as a federal grant or private donation. Subgrantee accounting is also available in the grant structure and is used to track advances, expenditures, budgets, and other activity for recipients of state or pass-through grants. Agencies can set up grant structure through the 29 Grant Control, D47 Grant Number, D40 Grant Category, D28 Grantor, and D35 Grant Type profiles. The Grant may be designated in the accounting transaction by the PCA or Index.

The Project Structure is used to track budgets, revenues, expenditures, and statistics for an activity, such as a capital project or interagency agreement. Agencies can set up a project structure through the 27 Project Control, D42 Project Number, D06 Project Type, and D41 Project Category profiles. The Project may be designated in the accounting transaction by the PCA or Index.

So far, we have looked at each of the R⋆STARS structures – Fund, General Ledger, Object, Appropriation, Program, Organization, Projects, and Grants – individually. In practice, a specific transaction may post to several of these structures. In addition, when a user performs an online inquiry or the system produces a report, R⋆STARS categorizes data across structures. Following are diagrams of how some of the structures work together.

R⋆STARS uses the transaction code, agency or comptroller object, and PCA and/or Index to categorize and summarize accounting transactions and produce the information needed for the ACFR and individual agency Combined Balance Sheet.

R⋆STARS uses the agency or comptroller object and PCA and/or Index to categorize and summarize accounting transactions and to produce the information needed for the ACFR and for individual agency Statements of Revenue, Expenditure, and Changes in Fund Balance.

R⋆STARS uses the agency or comptroller object and PCA and/or Index to categorize and summarize accounting transactions and to produce the information needed to track expenditures and revenue for appropriations and budget. Agencies may choose to further categorize this activity for a particular grant or project.

|

D15 Appropriation Group | |||||||

|

D22 Appropriated Fund | |||||||

|

20 Appropriation | |||||||

|

001 |

General Fund | ||||||

|

8000 |

General Fund | ||||||

|

89901 |

General Fund Appropriation | ||||||

|

8010 |

General Fund – Capital Improvement |

||||||

|

77303 |

General Fund Receipts | ||||||

|

002 |

Federal Funds | ||||||

|

6010 |

Federal Funds – Capital Improvement | ||||||

|

003 |

Other Funds | ||||||

|

3010 |

Other Funds Capital Improvement | ||||||

|

30488 |

Capital Improvements | ||||||

|

3020 |

Other Funds Capital Construction | ||||||

|

30441 |

Library Seismic Upgrades | ||||||

|

3200 |

Other Funds – Non-limited |

||||||

|

31556 |

DAS Operating – NL | ||||||

|

3230 |

Other Funds – Debt Service – Non-limited | ||||||

|

31557 |

DAS Operating Debt Service – NL | ||||||

|

3400 |

Other Funds Limited | ||||||

|

004 |

Federal Funds – Non-budgeted | ||||||

|

6600 |

Federal Funds – Non-budgeted | ||||||

|

65550 |

Federal Flood Control Leases |

||||||

|

005 |

Other Funds – Non-budgeted | ||||||

|

3600 |

Other Funds – Non-budgeted | ||||||

|

35250 |

City Revenue Sharing | ||||||

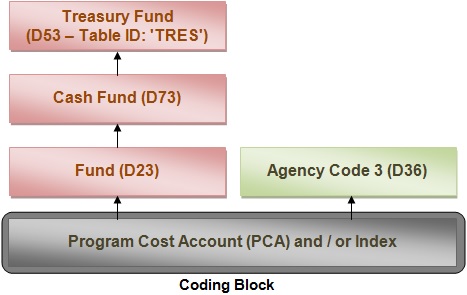

R⋆STARS uses the Agency Code 3 to identify the Treasury Account Number for revenue. The PCA may imply the Agency Code 3.

For transactions, the coding block may include:

◾ Fund (D23)

◾ Appropriation Year

◾ Comptroller GL Account (D31) or Agency GL Account (D32)

◾ Comptroller Object (D10) or Agency Object (D11)

◾ Appropriation Number (20)

◾ Project Control (27)

◾ Grant Control (29)

In order to reduce the amount of coding that a user is required to enter, R⋆STARS has coding reduction techniques for some of these elements.

The PCA is one coding reduction feature related to the Program Structure. It is established in the 26 profile. Its purpose is to imply an agency’s Fund Structure, Appropriation Number, Program Structure, Project and Grant Structure.

The Index is another coding reduction feature that focuses on the Organization Structure of an agency. The index is established in the 24 profile. It has the capability to imply Fund Structure, Appropriation Number, Organization Structure, Grants and Project.

To summarize, these structures can be implied or looked up by a PCA or Index:

|

STRUCTURE |

PCA |

INDEX |

|

Fund |

yes |

yes |

Click on the image below to get a printable, legal-sized version of the PLACEMAT.