R⋆STARS

Data Entry Guide

R⋆STARS

Data Entry Guide

Chapter #6

Non‑Descriptive Profiles

Purpose

This chapter is intended to provide system users with an understanding of profile maintenance requirements for non-descriptive profiles.

Table

Of Contents

6-1 Profile

Maintenance and Hierarchies

6-2 Relationship

to Other Profiles

01 Labor Distribution Control

Profile

05 Time Sheet Profile / 06

Adjusted Time Sheet Profile

17 Object Clearance Patterns

Profile

20 Appropriation Number

Profile

21 Index/PCA Relationship

Profile

23 Cost Allocation Type

Profile

28A and 28B Transaction Code

Profiles

36 Vendor Amount Limit

Profile

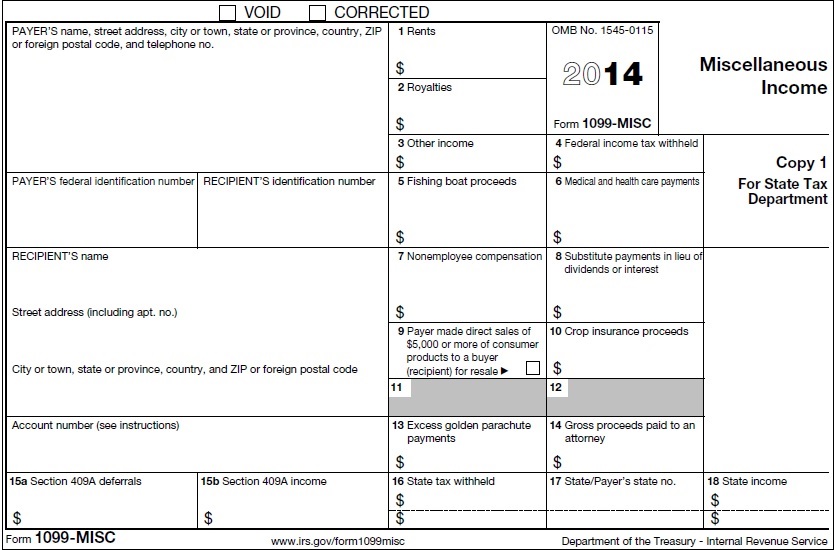

43M On‑Line 1099

Miscellaneous Summary Profile

54 Agency Receivable Document

Exemption Profile

82 Comptroller Relationship

Edit Profile

92 Grant/Project Billing

Request Profile

93 Recurring Transaction Request

Profile

95 Report Distribution

Profile

550 Recurring Transaction

Profile

6-1 Profile

Maintenance and Hierarchies

For information on general profile maintenance and hierarchies, refer to Chapter #5, para. 5-1 through 5-4.

6-2 Relationship

to Other Profiles (Not Used in Oregon)

Many other system profiles are used to validate the

classification element values coded on the Labor Distribution Subsystem (LDS)

profiles. The following chart indicates which system profiles are required for

each LDS profile.

|

LDS PROFILE |

REQUIRED PROFILES |

||||

|

01 |

LC – Labor Distribution Control |

24 |

Index |

25 |

Agency Control |

|

4A |

EM – Employee Master |

01 |

Labor Distribution Control |

24 |

Index |

|

05 |

TS – Time sheet |

4A |

Employee Master |

24 |

Index |

|

07 |

AP – Adjustment Payroll |

4A |

Employee Master |

05 |

Time sheet |

|

08 |

PI – Payroll Interface |

D02 |

Agency |

D10 |

Comptroller Object |

Below are the coding instructions for each of the LDS profiles.

6-3

non-Descriptive Profiles

01

Labor Distribution Control Profile (Not Used in Oregon)

The 01 (LC) Profile contains a variety of data elements that are used to control the processing performed by the Labor Distribution Subsystem. Each agency using Labor Distribution must establish one profile for the year. This profile controls the method of labor charge distribution used agency wide and contains certain default classification elements.

Control Key

◾ AGENCY – Enter the three-character Agency code which must exist in the 25 – Agency Control Profile.

◾ FISCAL YR – Enter the two-digit Fiscal Year, which must match the AGENCY/FY in the 25 profile.

Information

Elements

Whenever the Index or PCA is optional under a specific condition, either the Index or the PCA must be coded.

Unless otherwise noted, the following coding rules apply to all Comptroller Object and Agency Object combinations on this profile:

1. Whenever the Comptroller Object and Agency Object are optional, either the Comptroller Object or the Agency Object must be coded.

2. If the Comptroller Object is coded, the Agency Object may be blank.

3. If the Agency Object is coded and the Comptroller Object is blank, the D11 – Agency Object Profile must contain a Comptroller Object value.

4. If the Comptroller Object and the Agency Object are both coded, the D11 Comptroller Object must match the coded Comptroller Object or the D11 Comptroller Object must be blank.

◾ CTO RATE – Enter the five-digit Comp Time Off (CTO) Rate as #.####. For example, 1.5000 equals CTO accrual rate of 150% of regular pay. The CTO Rate must be equal to or greater than 1.0000 when the DIST METHOD is A or S. If the DIST METHOD is I, this field must be left blank.

◾ CTO INDEX – Enter the five-digit CTO Index for accumulating the CTO reserve. This field is optional if the DIST METHOD is A or S. If coded, Agency/CTO INDEX/FY must exist in the 24 – Index Profile. When he DIST METHOD is equal to I, this field must be blank.

◾ CTO PCA – Enter the five-digit , which must exist in the 26 – PCA Profile. This field is optional if the DIST METHOD is A or S. If the DIST METHOD is equal to I, this field must be blank.

◾ COBJ RG – Enter the four-digit Comptroller Object (COBJ) Regular, which must be defined in the D10 – Comptroller Object Profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be blank.

◾ AOBJ RG – Enter the four-digit Agency Object (AOBJ) Regular, which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be left blank.

◾ COBJ OT – Enter the four-digit COBJ Overtime which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be blank.

◾ AOBJ OT – Enter the four-digit AOBJ Overtime which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be left blank.

◾ COBJ SB – Enter the four-digit COBJ Standby, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be blank.

◾ AOBJ SB – Enter the four-digit AOBJ Standby, which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be left blank.

◾ COBJ PR – Enter the four-digit COBJ Premium, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be left blank.

◾ AOBJ PR – Enter the four-digit AOBJ Premium, which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A or I, this field must be left blank.

◾ COBJ PS – Enter the four-digit COBJ Payroll Statistics, which must be defined in the D10 profile. This field is optional when STATISTICS is B or P. If STATISTICS is N or T, this field must be left blank.

◾ AOBJ PS – Enter the four-digit AOBJ Payroll Statistics, which must be defined in the D11 profile. This field is optional when STATISTICS is B or P. If STATISTICS is N or T, this field must be blank.

◾ DIST METHOD – The Distribution

Method identifies the methods used to distribute gross wages. This is a

required field. Enter the one-character indicator as follows:

|

A |

– |

Actual Method |

I |

– |

Interface Method |

S |

– |

Standard Method |

◾ COBJ TS – Enter the four-digit COBJ Time Sheet, which must be defined in the D10 profile. This field is optional when STATISTICS is B or T. If STATISTICS is N or P, this field must be left blank.

◾ AOBJ TS – Enter the four-digit AOBJ Time Sheet, which must be defined in the D11 profile. This field is optional when STATISTICS is B or T. If STATISTICS is N or P, this field must be blank.

◾ STAFF BENEFITS – Staff

Benefits identifies whether actual or standard methods are used to distribute

employer paid benefit costs. Enter the one-character indicator as follows:

|

A |

– |

Actual |

S |

– |

Standard |

This field is required when the DIST METHOD is A or S. When the DIST METHOD is S, STAFF BENEFITS must be S. If the DIST METHOD is I, this field must be blank.

◾ UNDIST ACCT – Identifies the accounting classification for the labor charges when no EM Profile record is found to match the payroll record. The Undistributed Account Index (UNDIST ACCT INDEX) and/or PCA are posted only if the payroll record does not match either an individual or group EM Profile record.

◾ UNDIST ACCT INDEX – Enter the five-digit Undistributed Account Index, which must be defined in the 24 profile. This field is optional when the DIST METHOD is A or S. If the DIST METHOD is equal to I, this field must be blank.

◾ UNDIST ACCT PCA – Enter the five-digit Undistributed Account PCA which must be defined in the 26 profile. This field is optional if the DIST METHOD is A or S. If the DIST METHOD is equal to I, this field must be blank.

◾ STATISTICS – Identifies

whether the payroll and time sheet hours are to be recorded in R⋆STARS.

Enter the one-character Statistics indicator as follows:

|

P |

– |

Record Payroll Hours |

N |

– |

Do Not Record Hours |

This field is required and must be N or P when the DIST METHOD is I.

Default

Accounts

Identifies the accounting classification for labor charges which may be distributed when a DOE, passed from the payroll system, is not entered on the PI Profile.

◾ DEFAULT ACCT INDEX – Enter the five-digit Default Account Index which must be defined in the 24 profile. This field is optional.

◾ DEFAULT ACCT PCA – Enter the five-digit Default Account PCA which must be defined in the 26 profile. This field is optional.

◾ DEFAULT ACCT COBJ – Enter the four-digit Default Account COBJ which must be defined in the D10 profile. This field is optional. The object editing rules mentioned at the beginning of these coding instructions do not apply to this data element. If left blank, the COBJ value on the Payroll Interface Profile for the DOE will be used.

◾ DEFAULT ACCT AOBJ – Enter the four-digit Default Account AOBJ which must be defined in the D11 profile. This field is optional. The object editing rules mentioned at the beginning of these coding instructions do not apply to this data element. If left blank, the AOBJ value on the Payroll Interface Profile for the DOE will be used.

Standard

Benefits

Identifies the accounting classification used to accumulate the credit for the standard benefits. If the STAFF BENEFITS is S, these fields are optional. If STAFF BENEFIT is A, these fields must be blank.

◾ STD BENEFIT INDEX – Enter the five-digit Standard Benefit Index which must be defined in the 24 profile. This field is optional.

◾ STD BENEFIT PCA – Enter the five-digit Standard Benefit PCA which must be defined in the 26 profile. This field is optional.

◾ STD BENEFIT COBJ – Enter the four-digit Standard Benefit COBJ which must be defined in the D10 profile.

◾ STD BENEFIT PCNT – Enter the Standard Benefit Percentage Rate as #.####, where 0.1000 equals 10%. This is used to charge the classification for standard benefits distribution. This field is required if any of the STANDARD BENEFIT HOUR TYPES (RG, OT, SB and PR) are not N.

◾ STD BENEFIT INDICATORS RG, OT, SB and PR(N) - Indicates

whether benefit costs should be calculated for the following Hours Types:

Regular (RG), Overtime (OT), Standby (SB), and Premium (PR). Enter the

one-character indicator as follows:

|

Y |

– |

Calculate standard benefit for this hour type. |

These indicators are required.

Time

Sheet Hours Coding

◾ OT CODING – Enter the

one-character Overtime Coding indicator as follows:

|

Y |

– |

Overtime hours are coded separately on time sheets. |

This field is required if the DIST METHOD is A or S, and not allowed if the DIST METHOD is I.

◾ SB CODING – Enter the

one-character Standby Coding Indicator as follows:

|

Y |

– |

Standby hours are coded separately on time sheets. |

This field is required if DIST METHOD is A or S. If DIST METHOD is I, this field must be left blank.

◾ PR CODING – Enter the

one-character Premium Coding indicator as follows:

|

Y |

– |

Premium hours are coded separately on time sheets. |

This field is required if DIST METHOD is A or S. If DIST METHOD is I, this field must be left blank.

◾ HOURLY RATE – Enter the

one-character Hourly Rate Indicator as follows:

|

Y |

– |

Use the payroll hourly rate to calculate labor distribution

charges |

This field must be blank if DIST METHOD is I.

Add-On

Information

Contains add-on hour type indicators, rates and charge and credit expenditure accounting classification information. These fields are optional if the DIST METHOD is A or S. If any add-on element is coded, the entire line must be coded. When the DIST METHOD is I, all the add-on fields must be blank.

◾ ADD-ON HOUR TYPE CODING – The add-on

hour types Regular (RG), Overtime (OT), standby (SB), Premium (PR), Paid Time

Off (TO), and Comp Time Off (CO) indicate whether add-on burden costs should be

allocated. Enter the one-character indicator as follows:

|

Y |

– |

Calculate the add-on for this hour type. |

This field is required.

◾ ADD-ON CHG PCNT – Identifies the percentage of labor dollars to be charged as add-on or burden rate. Enter the five-digit Add-On Charge Percent in format #.####, where 0.1000 = 10%. This field is required.

◾ ADD-ON CHG COBJ – Enter the four-digit Add-On Charge COBJ which must be defined in the D10 profile. This field is optional.

◾ ADD-ON CHG AOBJ – Enter the four-digit Add-On Charge AOBJ which must be defined in the D11 profile. This field is optional.

◾ ADD-ON CR INDEX – Enter the five-digit Add-On Credit Index which must be defined in the 24 profile. This field is optional.

◾ ADD-ON CR PCA – Enter the five-digit Add-On Credit PCA which must be defined in the 26 profile. This field is optional.

◾ ADD-ON CR COBJ – Enter the four-digit Add-On Credit COBJ which must be defined in the D10 profile. This field is optional. The object editing rules mentioned at the beginning of these coding instructions do not apply to this data element. If left blank, the Add-On Charge COBJ will be used.

◾ ADD-ON CR AOBJ – Enter the four-digit Add-On Credit AOBJ which must be defined in the D11 profile. This field is optional. The object editing rules mentioned at the beginning of these coding instructions do not apply to this data element. If left blank, the Add-On Charge AOBJ will be used.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format), which identifies when the record becomes effective. This field can be left blank, which will cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format), which identifies when the record is no longer effective. This field can be left blank.

– No Profile Example Available –

4A

Employee Master Profile (Not Used in Oregon)

The 4A (EM) Profile is a two screen profile that contains distribution classification information at the employee or group level. Individual employees and employee groups can have up to ten predetermined allocations for distributing payroll costs. These predetermined distributions are posted when no time sheet is entered. Also, these distributions are posted if a time sheet is entered and the time sheet hourly rate option is used and the time sheet hours do not equal the payroll hours.

Compensatory time-off, add-ons and standard benefit information may be optionally coded on the EM Profile. If coded, this information overrides the agency-level information coded on the LC Profile.

The record must first be recalled or added from 4A before data on 4B can be updated. The function key F6 provides a toggle between the two screens. 4B can only be accessed from screen 4A through function key F6 .

Control Key

◾ AGENCY – Enter the three-character Agency code, which must be defined and in active status in the LC profile. This is a required field.

◾ INDEX – Enter the five-digit Index code. Agency, Index, and Fiscal Year must be defined in the 24 profile. This is a required field.

◾ EMP CLASS – Enter the three-character Employee Class code. The Employee Class identifies an employee or group of employees that share common accounting classification attributes.

If EMP TYPE coded below is S this field is required. If EMP TYPE is G this field is ptional. If coded, the EMP CLASS must be defined in the D53 – Titles Profile with the Table ID of EMPC.

◾ EMP NO – Enter the ten-digit Employee Number. If EMP TYPE is S, this field is required. If EMP TYPE is G, leave blank.

◾ FY – Enter the two-digit Fiscal Year (FY). This field is required.

Information

Elements

Whenever the Index or PCA is optional under a specific condition, either the Index or the PCA must be coded.

The following coding rules apply to all Comptroller Object and Agency Object combinations on this profile:

1. Whenever the Comptroller Object and Agency Object are optional, either the Comptroller Object or the Agency Object must be coded.

2. If the Comptroller Object is coded, the Agency Object may be blank.

3. If the Agency Object is coded and the Comptroller Object is blank, the D11 Agency Object Profile must contain a Comptroller Object value.

4. If the Comptroller Object and the Agency Object are both coded, the D11 Comptroller Object must match the coded Comptroller Object or the D11 Comptroller Object must be blank.

◾ NAME – Enter the thirty character name of the employee or group. This is a required field.

◾ STD RATES RG – Enter the eight-digit rate-per-hour for Regular time in #####.## format. If the DIST METHOD coded below is A or the DIST METHOD is blank and the Labor Distribution Control Profile for the AGENCY is A, this field must be blank. If the DIST METHOD is S, this field is required.

◾ STD RATES OT – Enter the eight-digit rate-per-hour for Overtime in #####.## format. If the DIST METHOD is A or the DIST METHOD is blank and the Labor Distribution Control Profile for the AGENCY is A, this field must be blank. If the DIST METHOD is S, this field is required.

◾ STD RATES SB – Enter the eight-digit rate-per-hour for Standby time in #####.## format. If the DIST METHOD is A or the DIST METHOD is blank and the Labor Distribution Control Profile for the AGENCY is A, this field must be blank. If the DIST METHOD is S, this field is required.

◾ STD RATES PR – Enter the eight-digit rate-per-hour for Premium time in #####.## format. If the DIST METHOD is A or the DIST METHOD is blank and the Labor Distribution Control Profile for the AGENCY is A, this field must be blank. If the DIST METHOD is S, this field is required.

◾ COBJ RG – Enter the four-digit COBJ for Regular time, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ AOBJ RG – Enter the four-digit AOBJ for Regular time which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ COBJ OT – Enter the four-digit COBJ for Overtime, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ AOBJ OT – Enter the four-digit AOBJ for Overtime which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ COBJ SB – Enter the four-digit COBJ for Standby time, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ AOBJ SB – Enter the four-digit AOBJ for Standby time which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ COBJ PR – Enter the four-digit COBJ for Premium time, which must be defined in the D10 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ AOBJ PR – Enter the four-digit AOBJ for Premium time which must be defined in the D11 profile. This field is optional when the DIST METHOD is S. If the DIST METHOD is A, this field must be blank.

◾ COBJ PS – Enter the four-digit COBJ for Payroll Statistics, which must be defined in the D10 profile. This field is optional when STATISTICS is B or P. If STATISTICS is N or T, this field must be blank.

◾ AOBJ PS – Enter the four-digit AOBJ for Payroll Statistics which must be defined in the D11 profile. This field is optional when STATISTICS is B or P. If STATISTICS is N or T, this field must be blank.

◾ COBJ TS – Enter the four-digit COBJ for Time Sheet Statistics, which must be defined in the D10 profile. This field is optional when STATISTICS is B or T. If STATISTICS is N or P, this field must be blank.

◾ AOBJ TS – Enter the four-digit AOBJ for Time Sheet Statistics which must be defined in the D11 profile. This field is optional when STATISTICS is B or T. If STATISTICS is N or P, this field must be blank.

◾ EMP TYPE (Required) – Enter

the one-character Employee Type as follows:

|

G |

– |

Group |

S |

– |

Single |

◾ TIME SHEET REQ – Enter the

one-character Time Sheet Required indicator as follows:

|

Y |

– |

Time sheet is required for the group or employee |

This is a required field.

◾ DIST METHOD – The Distribution

Method identifies whether actual or standard methods are used to distribute

gross wages for the group or employee. Enter the one-character DIST METHOD

indicator as follows:

|

A |

– |

Actuals |

S |

– |

Standards |

If the LC profile DIST METHOD is coded, this field is optional.

◾ STAFF BENEFITS – Staff

Benefits identify whether actual or standard methods are used to distribute

employer benefit costs. Enter the one-character indicator as follows:

|

A |

– |

Actuals |

S |

– |

Standards |

If the DIST METHOD is blank, this field is optional. If coded, STAFF BENEFITS must be A or S if DIST METHOD is A or STAFF BENEFITS must be S if DIST METHOD is S.

◾ HOME BASE ACCOUNT (N) – Enter the Home Base accounts to which labor costs are posted for the hours not recorded on a labor time sheet. HOME BASE ACCOUNT is required for the first line and optional for HOME BASE lines 2-10.

◾ HOME BASE PCNT (N) – Enter the six-digit Home Base Percent to be used in distributing labor costs for the hours not recorded on a labor time sheet in #.#### format where 0.1000 = 10%. The sum of all non-blank percents must be 1.0000.

◾ HOME BASE AY (N) – Enter the two-digit Home Base Appropriation Year.

◾ HOME BASE INDEX (N) – Enter the five-digit HOME BASE INDEX, which must be defined in the 24 Profile for the HOME BASE AY coded. This is an optional field.

◾ HOME BASE PCA (N) – Enter the five-digit Home Base PCA, which must be defined in the 26 profile for the HOME BASE AY coded. This is an optional field.

◾ HOME BASE GRANT/PH (N) – Enter the six-digit Home Base Grant and two-digit Home Base Grant Phase, which must be defined in the 29 – Grant Control Profile. This is an optional field.

◾ HOME BASE PROJECT/PH (N) – Enter the six-digit Home Base Project and two-digit Home Base Project Phase, which must be defined in the 27 – Project Control Profile. This is an optional field.

◾ HOME BASE ACD1 (N) – Enter the three-digit Agency Code 1, which must be defined in the D26 – Agency Code 1 Profile. This is an optional field.

◾ HOME BASE ACD2 (N) – Enter the three-digit Agency Code 2, which must be defined in the D27 – Agency Code 2 Profile. This is an optional field.

◾ HOME BASE ACD3 (N) – Enter the six-digit Agency Code 3, which must be defined in the D36 – Agency Code 3 Profile. This is an optional field.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format), which identifies when the record becomes effective. This field can be left blank, which will cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format), which identifies when the record is no longer effective. This field can be left blank.

◾ CTO INDEX – Enter the five-digit CTO Index for accumulating the CTO reserve if different from the Labor Distribution Control Profile. This field is optional. If CTO PCA or CTO PCNT is coded, then this field is optional. If coded, the CTO INDEX must be defined in the 24 profile.

◾ CTO PCA – Enter the five-digit CTO PCA if different from the 1 Labor Distribution Control Profile. This field is optional. If CTO INDEX or CTO PCNT is coded, then this field is optional. If coded, the CTO PCA must be defined in the 26 profile.

◾ CTO PCNT – Enter the six-digit CTO PERCENT in X.XXXX format where 0.1000 = 10%. This is an optional field. If CTO INDEX or CTO PCA is coded, then this field is required and must be equal to or greater then 1.0000.

Standard Benefits

Identifies the accounting classification used to accumulate the credit for standard benefits if different from the Labor Distribution Control Profile. If Distribution Method is A or I, these fields must be blank. If Distribution Method is S, these fields are optional.

◾ STANDARD BENEFIT INDEX (N) – Enter the five-digit Standard Benefit Index, which must be defined in the 24 profile. This is an optional field.

◾ STANDARD BENEFIT PCA (N) – Enter the five-digit Standard Benefit PCA, which must be defined in the 26 profile. This is an optional field.

◾ STANDARD BENEFIT COBJ (N) – Enter the four-digit Standard Benefit Comptroller Object, which must be defined in the D10 profile. This is an optional field.

◾ STANDARD BENEFIT AOBJ (N) – Enter the four-digit Standard Benefit AOBJ, which must be defined in the D11 profile. This is an optional field.

◾ STANDARD BENEFIT PCNT (N) – Enter the six-digit Standard Benefit Percent rate as #.####, where 0.1000 = 10%. This is used to charge the classification for standard benefits distribution. If Standard Benefit Indicator RG, OT, SB, and PR are all N, this field must be blank.

◾ STANDARD BENEFIT INDICATORS RG, OT, SB and PR (N)

– Indicates whether benefit costs should be calculated for the

following hour types: Regular (RG), Overtime (OT), Standby (SB), and Premium

(PR). Enter the one-character indicator as follows:

|

Y |

– |

Calculate the standard benefit for this hour type |

These indicators are required.

Add-On Information

Contains add-on applicability indicators, rates, and expenditure and credit accounts for add-on costs if different from the Labor Distribution Control Profile.

◾ ADD-ON INDICATORS RG, OT, SB, PR, TO AND CO (N) – The

add-on hour types Regular (RG), Overtime (OT), Standby (SB), Premium (PR), Paid

Time Off (TO), and Compensatory Time Off (CO) indicate whether add-on burdened

costs should be allocated. Enter the one-character indicator as follows:

|

Y |

– |

Calculate the add-on for this hour type |

These indicators are required.

◾ ADD-ON CHG PCNT (N) – Identifies the percentage of labor dollars to be charged as add-on or burdened rates. Enter the five-digit Add-On Charge Percent in #.#### format, where 0.1000 is 10%. This is a required field.

◾ ADD-ON CHG COBJ (N) – Enter the four-digit Add-On Charge COBJ, which must be defined in the D10 profile. This is an optional field.

◾ ADD-ON CHG AOBJ (N) – Enter the four-digit Add-On Charge AOBJ, which must be defined in the D11 profile. This is an optional field.

◾ ADD-ON CR INDEX (N) – Enter the five-digit Add-On Credit Index, which must be defined in the 24 profile. This is an optional field.

◾ ADD-ON CR PCA (N) – Enter the five-digit Add-On Credit Pca, which must be defined in the 26 profile. This is an optional field.

◾ ADD-ON CR COBJ (N) – Enter the four-digit Add-On Credit COBJ, which must be defined in the D10 profile. This is an optional field.

◾ ADD-ON CR AOBJ (N) – Enter the four-digit Add-On Credit AOBJ, which must be defined in the D11 profile. This is an optional field.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format), which identifies when the record becomes effective. This field can be left blank, which will cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format), which identifies when the record is no longer effective. This field can be left blank.

– No Profile Example Available –

05

Time Sheet Profile / 06 Adjusted Time Sheet Profile (Not Used in Oregon)

Input coding instructions for the 05 (TS) profile are identical to the 06 (AT) profile and are provided below. The TS profile is used to add, change, and delete employee time sheets prior to the processing of Labor Distribution. The AT profile is used to add, change, and delete an employee’s time sheet data after labor distribution has processed the affected period and changes need to be reprocessed. The original time sheet is not deleted before the adjustment cycle.

Control Key

The control key for the Time Sheet and Adjusted Time Sheet must match an existing Employee Master record with the full key or match a group Employee Master record without regard to employee number or with or without regard to employee class.

◾ AGENCY – Enter the three-character Agency code. This is a required field.

◾ INDEX – Enter the five-digit Index code. This is a required field.

◾ EMP CLASS – Enter three-character Employee Class code. This is a required field.

◾ EMP NO – Enter the ten-digit Employee Number. This is a required field and should begin with a 0 (zero) followed by the employee’s nine-digit Social Security Number.

◾ PERIOD – Enter the six-digit Period (MMDDYY format). This is a required field.

◾ SERVICE DATE – Enter the six-digit Service Date (MMDDYY format) identifying the date the hours were worked. This is an optional field.

◾ PAGE – Enter the two-digit Page number of the time sheet. This is a required field.

◾ TOTAL HOURS – This field is system-calculated. The system adds the total of all Hours + Machine Utilization Hours + Service Units amounts entered on the time sheet or adjusted time sheet. This is an optional field. The user may enter this field for use in entry balancing.

Information

Elements

Whenever the Index or PCA is optional under a specific condition, either the Index or the PCA must be coded.

◾ HOURS – Enter the number of Hours (999.9 format). HOURS must be greater than zero. This field is required for the first time sheet line and optional for time sheet lines 2-12. If HOUR TYPE (HT), entered below, is coded in time sheet lines 2-12, this field is required.

◾ HT – Enter the two-character

Hour Type as follows:

|

RG |

– |

Regular Time |

TO |

– |

Time Off |

This is a required field if the HOURS field is numeric and greater than zero.

◾ HB – Enter the one-character

Home Base (HB) indicator as follows:

|

Y |

– |

Yes, distribute time sheet line to home base accounts |

This is a required field if the HOURS field is numeric and greater than zero. If HOUR TYPE is CD or VT, this field must be N. If HOUR TYPE is CO, this field must be Y.

◾ AY – Enter the two-digit Appropriation Year (AY). If HB is Y, this field must be left blank. If HB is N, this field is required.

◾ INDEX – Enter the five-digit Index identifying the accounting classification to which the time sheet line is to be distributed. If HB is Y, this field must be blank . If HB is N, this field is optional. If coded, the INDEX must be defined in the 24 Profile.

◾ PCA – Enter the five-digit PCA identifying the accounting classification to which the time sheet line is to be distributed. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, the PCA must be defined in the 26 profile.

◾ GRANT/PH – Enter the six-digit Grant and two-digit Phase to which the time sheet line is to be distributed. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, the GRANT and PHASE must be defined in the 29 profile.

◾ PROJECT/PH – Enter the six-digit Project and two-digit Phase to which the time sheet line is to be distributed. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, the Project and Phase must be defined in the 27 profile.

◾ ACD1 – Enter the four-digit Agency Code 1. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, ACD1 must be defined in the D26 profile.

◾ ACD2 – Enter the four-digit Agency Code 2. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, ACD2 must be defined in the D27 profile.

◾ ACD3 – Enter the six-digit Agency Code 3. If HB is Y, this field must be blank. If HB is N, this field is optional. If coded, ACD3 must be defined in the D36 profile.

◾ MU – Enter the numeric Machine Utilization (MU – ###.# format). If HB is Y, this field must be blank. If HB is N, this field is optional.

◾ MC – Enter the three-digit Machine Class (MC). If MU is blank, this field must be blank. If MU is coded, this field is required. If coded, the MC must be defined in the D53 profile with Table ID MACH.

◾ SU – Enter the three-digit Service Units (SU). If HB is Y, this field must be blank. If HB is N, this field is optional.

◾ AOBJ – Enter the four-digit Service Units AOBJ, which must be defined in the D11 profile. If SU is coded or HOUR TYPE is VT, this field is required. The Comptroller Object (COBJ) in the D11 AOBJ record must not be blank.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This is a required field. This code will default to an Active status if not entered.

◾ CREATE DATE – This is a display-only field and reflects the system date the time sheet record was created.

– No Profile Examples Available –

07

Adjustment Payroll Profile (Not Used in Oregon)

The 07 (PT) Profile identifies the specific time sheet records used during the regular distribution cycle that must be reversed during an adjustment cycle. Only those employees with a TS, AT and PT profile record are processed during an adjustment cycle.

Control Key

The control key be defined in the TS profile and the AT profile with full key. The Agency, Index, Employee Class, Employee Number, Fiscal Year must be defined in the EM profile with full key or without Employee Number and with or without Employee Class.

◾ AGENCY – Enter the three-character Agency code.

◾ INDEX – Enter the five-digit Index code.

◾ EMP CLASS – Enter the three-character Employee Class code.

◾ EMP NO – Enter the ten-digit Employee Number.

◾ FY – Enter the two-digit Fiscal Year.

◾ PAY PERIOD – Enter the six-digit Pay Period (MMDDYY format). Note that this data element is not in the 4A profile.

Information

Elements

◾ NAME – Enter the eleven-character name of the employee.

◾ PAYROLL LEVEL 2 – Enter the two-character Payroll Level code. This is a required field.

◾ GROSS PAY DOE – Enter the two-character DOE code. This is a required field. The AGENCY, PAYROLL LEVEL 2 AND GROSS PAY DOE must be defined in the 08 – Payroll Interface Profile (PI) with the coded Agency or Agency 000. The Gross Pay DOE must be DOE TYPE E.

◾ GROSS PAY AMOUNT – Enter the Gross Pay Amount as #####.##. This is a required field.

◾ HOURS – Enter the seven-digit Hours associated with each Gross Pay Amount as #####.##.

◾ DOE 1-20 – Enter the two-character DOE that identifies the fringe benefit associated with the Gross Pay Amount. The AGENCY, PAYROLL LEVEL 2 and DOE must be defined in the PI profile with the coded Agency or Agency 000. The benefit DOE must be DOE TYPE F. The DOE is required if its associated Amount is entered.

◾ AMOUNT 1-20 – Enter the Benefit Amount associated with the fringe benefit DOE as #####.##. The Amount is required if its associated DOE is entered.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format), which identifies when the record becomes effective. This field can be left blank, which will cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format), which identifies when the record is no longer effective. This field can be left blank.

– No Profile Example Available –

08

Payroll Interface Profile (Not Used in Oregon)

The 08 (PI) Profile defines the payroll types or DOE’s (distributions and other earnings) and their characteristics that are passed from the payroll system to LDS. This is a system wide profile that can be customized by individual agencies to meet agency-specific requirements.

Control Key

◾ AGENCY (Required) – Enter the three-character Agency code, which must exist in the D02 – Agency Profile or enter Agency 000.

◾ PAYROLL LEVEL 2 (Required) – Enter the two-digit Payroll Level.

◾ DOE (Required) – Enter the two-character DOE (Distribution and Other Earnings) code.

Information

Elements

◾ TITLE (Required) – Enter the DOE Title up to 40 characters.

◾ DOE TYPE (Required) – Enter

the two-character DOE Type code as follows:

|

E |

– |

Gross Earnings/Salary |

N |

– |

Net Pay Amount |

◾ PAYMENT CATEGORY – Enter the

one-character Payment Category as follows:

|

D |

– |

Distributable – These costs are distributed by

the labor distribution system. |

This is a required field if the DOE Type is E or F. If the DOE Type is N or D, this field must be left blank.

◾ TRANS CODE – Enter the three-digit Transaction Code, which must exist in the 28A – Transaction Code Decision Profile. This field is optional if the DOE Type is D, F or N. If the DOE Type is E, this field must be blank.

◾ PAYMENT TYPE – Enter the

one-digit Payment Type as follows:

|

0 |

– |

Regular Salary and Wages |

3 |

– |

Premium Wages |

This field identifies the type of pay the DOE represents and is required if DOE Type is E and Payment Category is D. If DOE Type is D, F or N, or Payment Category is S, this field must be blank.

◾ FUND – Enter the four-digit Fund. This field is optional if DOE Type is D, F or N, and must exist in the D23 – Fund Profile if the Agency is not equal to 000. If the DOE Type is E, this field must be blank

◾ GL ACCT – Enter the four-digit General Ledger Account. This field is optional if DOE Type is D, F or N and the GL Account Indicator in the 28A profile for the Transaction Code is not equal to N. It also must be defined in the D31 – Comptroller General Ledger Account Profile. GENERAL LEDGER ACCOUNT is not allowed if the DOE Type is E or if the DOE Type is D, F or N and the GL Account Indicator in the 28A profile for the Transaction Code is equal to N.

◾ COMP OBJ – Enter the four-digit Comptroller Object, which must exist in the D10 profile. This field is required if the DOE Type is E or F and not allowed if the DOE Type is D or N.

◾ AGENCY GL – Enter the eight-digit Agency General Ledger. This field is required if the DOE TYPE is D, F or N and the AGL Account Indicator in the 28A profile for the Transaction Code is not equal to N. In addition, the Agency General Ledger must exist in the D32 – Agency General Ledger Profile or must be in AAAFFFFO format where AAA is Agency and FFFF is Fund, which is defined in the D23 profile.

If DOE Type is E, D, F or N and the AGL Indicator in the 28A profile for the Transaction Code is N, this field must be blank.

◾ AGY OBJ – Enter the four-digit Agency Object which must exist in D11 profile. This field is optional when the DOE Type is E or F. If the DOE Type is D or N this field must be left blank.

◾ VARIANCE PCA – Enter the five-digit Variance PCA to accumulate any labor distribution variance amounts. This field is required if DOE Type is E or F, and must be defined in the 26 profile if the Agency is not equal to 000. If the Agency is equal 000, The field must still be five-characters. When the DOE Type is D or N, this field must be left blank.

◾ SUPPLEMENTAL PCA – Enter the five-digit Supplemental PCA to accumulate supplemental labor costs. These are the labor costs that are not distributed during a normal labor distribution run. This field is required if Payment Category is S, and must be defined in the 26 profile if the Agency is not equal to 000. If the Agency is equal to 000, This field must still be five-characters. When the PAYMENT CATEGORY is not equal to S, this field must be blank.

◾ RESERVE PCA – Enter the five-digit Reserve PCA to accumulate reserve labor costs. This field is optional if DOE Type is E, and must be defined in the 26 profile if the Agency is not equal to 000. If Agency is equal to 000, the field must still be five-characters. When the DOE Type is D, F or N, this field must blank.

◾ BENEFIT BASE INDICATOR – Benefit

Base Indicators are used to identify whether Benefits are charged to the Hour

Type on the payroll charges. The Labor Types are Regular (RG), Overtime (OT),

Standby (SB), Premium (PR), Paid Time Off (TO), and Compensatory Time Off (CO).

Enter a one-digit character for each Benefit Base Indicator as follows:

|

Y |

– |

Charge the benefit amounts |

These are required fields when the DOE Type is F and Payment Category is D. If the DOE Type is F and Payment Category is D, at least one Benefit Base Indicator must be Y. If DOE Type is not F or Payment Category is not D, these fields must be left blank.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format), which identifies when the record becomes effective. This field can be left blank, which will cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format), which identifies when the record is no longer effective. This field can be left blank.

– No Profile Example Available –

10

Menu Control Profile

The 10 profile is used to define the structure of R⋆STARS menus, submenus, and screens. DAS SFMS Operations maintains this profile.

The 10 Profile also establishes valid Link To and Interrupt destinations using pneumonic screen names. For example, the 24 profile has the pneumonic name INDX. This allows the user to access the 24 profile by typing INDX in the LINK TO: field and pressing either Enter or F9 (Interrupt).

When making menu selections, users may enter the screen ID or press the corresponding function key. In the above Index example, the 24 profile can be accessed directly by typing 24 in the LINK TO: field and pressing ↵ Enter . It can also be reached by navigating to the ORGM Menu and pressing F8 (Line Number 7 on this screen).

The Item Number field controls the menu line on which the menu selection information displays. It is important to note the relationship between the line number and the function key. F1 and F9 function keys are reserved (for Help and Interrupt) and are not displayed as menu line choices. If a record has an Item Number of 07, it appears on the seventh line of the menu but corresponds with function key F8 . If a record has an Item Number of 10, it appears on the tenth line of the menu but corresponds with function key F12 . (The F1 –HELP and F9 –INTERRUPT function key information usually appears at the bottom of each screen.)

Control Key

◾ LINK TO ID – Enter up to a

four-character Link To ID. This field identifies the menu pneumonic, the screen

ID, or a pneumonic Link To ID. Examples of Link To IDs are as follows:

|

MAIN |

– |

to link to the Main Menu (menu pneumonic) |

Information

Elements

◾ MENU ID – Enter up to a four-character Menu ID or leave blank. Use this field to identify on which menu this record is to be displayed. For example, to display the Payment Processing menu on the Main Menu, enter MAIN in this field. It is recommended that Menu IDs be pneumonic because menus all use screen number 000.

◾ ITEM NO – Enter a two-digit Item Number (between 01 and 10) or leave blank. The Item Number determines on which line of the menu this record will display. R⋆STARS will right justify the Item Number. For example, if a user enters Item Number 8, the system right justifies the entry to 08. If the Menu ID field is blank, the system assigns an Item Number of zeros 00 and the record is not displayed as a menu choice (e.g. PCA).

◾ PROGRAM NAME – Enter an eight-character Program Name. For example, if the screen ID is D11, enter the screen’s Program Name of DAFMD11. Therefore, when a user is using the system, if the user enters D11 in the Link To field, the system displays the screen program identified on this record – AGENCY OBJECT PROFILE. If the record is establishing the menu structure (i.e., no screen IDs are on the record) the Program Name should be DAFM000.

◾ TITLE – Enter up to a 30-character Title of the menu or screen ID. This title appears as the title of the menu and/or the menu option. If spaces are added before the title, those spaces are reflected on the menu.

◾ STATUS CODE – This element is

required. Enter a one-character Status Code as follows:

|

A |

– |

Active |

I |

– |

Inactive |

This code will default to an Active status if not entered. It may be used to inactivate records no longer in use.

Example:

|

S010 UC: 10 STATE OF OREGON 04/04/14 10:07 AM |

|

LINK TO: MENU CONTROL PROFILE PROD |

|

|

|

LINK TO ID: D11 |

|

|

|

MENU ID: OBJM |

|

|

|

ITEM NO: 05 |

|

|

|

PROGRAM NAME: DAFMD11 |

|

|

|

TITLE: AGENCY OBJECT PROFILE |

|

|

|

STATUS CODE: A |

|

|

|

LAST PROC DATE: 04032014 |

|

Z06 RECORD SUCCESSFULLY RECALLED |

|

|

|

F1-HELP F3-DEL F5-NEXT F9-INT F10-SAVE F11-SAVE/CLEAR ENTER-INQ CLEAR-EXIT |

17

Object Clearance Patterns Profile

The 17 profile defines clearance patterns for Grant drawdown calculations. It allows patterns to be associated with a Grant, Agency Code 1, and/or Object within a Grant. Agency Code 1 is optional and is used to make tasks more specific within a certain Grant. The 17 profile is part of the Grant Billings process that is subject to the Cash Management Improvement Act (CMIA). This profile is Agency maintained.

Control Key

◾ AGENCY – Enter the three-character Agency code. It must exist in the D02 profile.

Information

Elements

◾ GRANT NO – Enter the six-digit Grant Number. It must exist in the 29 profile.

◾ GRANT PHASE – Enter the two-digit Grant Phase. The Grant Number and Phase must exist in the 29 profile.

◾ AGENCY CODE 1 – Enter up to a four-digit Agency Code 1 or leave blank. If entered, it must exist in the D26 profile.

◾ OBJECT RANGE FROM – Enter a four-digit D10 Comptroller Object or D11 Agency Object number or D48 – Grant Object Profile Grant Object that begins the range. Because this is a range, the system will not verify that the Comptroller Object exists in the D10 profile. The same logic holds true for Agency Objects in the D11 and Grant Objects in the D48 profiles.

◾ OBJECT RANGE TO – Enter a four-digit D10 Comptroller Object or D11 Agency Object number or D48 Grant Object number that completes the range. Because this is a range, the system will not verify that the Comptroller Object exists in the D10 profile. The same logic holds true for Agency Objects in the D11 and Grant Objects in the D48 profiles.

◾ CLEARANCE PATTERN – Enter up to a four-character (alpha/numeric) Clearance pattern, which, if entered, must exist in the 18 – Clearance Pattern Profile. If the Object Clearance Patterns are entered for this grant in this profile, the Clearance Pattern field in the 29 profile must be blank.

◾ STATUS CODE – Enter a

one-character Status Code. It will default to Active if not entered. It may be

used to inactivate records no longer in use.

|

A |

– |

Active |

I |

– |

Inactive |

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format). It identifies when the record becomes effective. This field can be left blank, it will default to the current date and cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format) or leave blank. EFF END DATE identifies when the record is no longer effective.

Example:

|

S017 UC: 10 STATE OF OREGON 04/04/14 10:06 AM |

|

LINK TO: OBJECT CLEARANCE PATTERNS PROFILE PROD |

|

|

|

AGENCY: 444 |

|

|

|

GRANT/PHASE: 100000 14 |

|

|

|

AGENCY CODE 1: 6001 |

|

|

|

OBJECT RANGE FROM: 0250 |

|

|

|

OBJECT RANGE TO: 0250 |

|

|

|

CLEARANCE PATTERN: ES10 |

|

|

|

STATUS CODE: A |

|

EFF START DATE: 07212013 EFF END DATE: LAST PROC DATE: 04012014 |

|

Z26 RECORD NOT FOUND – NEXT RECORD RECALLED |

|

|

|

F1-HELP F3-DEL F5-NEXT F9-INT F10-SAVE F11-SAVE/CLEAR ENTER-INQ CLEAR-EXIT |

18

Clearance Patterns Profile

The 18 profile defines clearance patterns for Grant drawdown calculations. It defines the days and percentages for the various clearance patterns used by the State. DAS SFMS Operations maintains this profile.

The 18 profile is part of the Grant Billings process that is subject to the Cash Management Improvement Act (CMIA). The CMIA process determines the date that the State Treasurer can draw down funds that are due to the State from the Federal Government. The date determined is the due date. This due date is the date the State Treasurer can draw down funds without incurring interest liabilities. CMIA affects final approved expenditures that are charged to a Grant that has an automatic billing method set up. The payment is derived using either the default days clearance from the D40 – Grant Category Profile or an average clearance day as set up on the 18 profile. An accounts receivable transaction, using the CMIA due date, is generated to indicate an amount due from the Federal Government using the coding block values found in the Recovery Segment of the 29 profile.

Control Key

◾ CLEARANCE PATTERN – Enter up to a four-character (alpha/numeric) Clearance Pattern code.

Information

Elements

◾ TITLE – Enter a Title of up to 50 characters.

◾ DAYS – Enter a two-digit number in the DAYS field in the format 01 to mean 1 day. The corresponding % must be entered if a day is entered and vice versa. If more than 1 set of days/% is entered, the days number must be in ascending order. For example, if you enter one of the days field as 02, then the next days field must be 03 or greater.

◾ % – Enter a three-digit number in the % field in the format 025 to mean 25% and 100 to mean 100%. The % must be greater than zero. The corresponding day must be entered if a % is entered and vice versa. If more than one set of days/% is entered, the %’s must =100%.

◾ STATUS CODE – Enter a

one-character Status Code. It will default to Active if not entered. It may be

used to inactivate records no longer in use.

|

A |

– |

Active |

I |

– |

Inactive |

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format). It identifies when the record becomes effective. This field can be left blank, it will default to the current date and cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format) or leave blank. EFF END DATE identifies when the record is no longer effective.

Example:

|

S018 UC: 10 STATE OF OREGON 04/04/14 10:08 AM |

|

LINK TO: CLEARANCE PATTERNS PROFILE PROD |

|

|

|

CLEARANCE PATTERN: ES10 TITLE: EST CLEAR – MEDICAID MMIS PMT SYS 93.778 |

|

|

|

DAYS/%: 02 001 03 037 04 032 05 016 06 007 07 002 08 001 09 001 10 001 14 002 |

|

DAYS/%: |

|

|

|

STATUS CODE: A |

|

EFF START DATE: 03202014 EFF END DATE: LAST PROC DATE: 03212014 |

|

Z06 RECORD SUCCESSFULLY RECALLED |

|

|

|

F1-HELP F3-DEL F5-NEXT F9-INT F10-SAVE F11-SAVE/CLEAR ENTER-INQ CLEAR-EXIT |

20

Appropriation Number Profile

The 20 profile determines the classification and level of control to be exercised over an appropriation. This Appropriation Number can be associated to or looked up by the 24 or 26 profiles. Therefore, the user organization need enter only the Index, PCA, or alternatively the Appropriation Number on the input transaction to identify a transaction to an appropriation. This profile also maintains many of the control indicators that relate to Appropriations, Allotments, Agency Budgets and allotments of Agency Budgets. The 20 profile is maintained and updated by DAS – Budget and Management Division (BAM). Specific agency budget element information is provided by agencies.

Prior to the beginning of each new biennium:

1. BAM distributes two spreadsheets to agencies:

a. The first lists all appropriations currently established on each agency’s 20 Profiles.

b. The second lists all of the agency’s appropriation bills with section references for the coming biennium. The spreadsheet has columns to provide accounting information such as PCA, Index, etc.

2. Agency reviews the listing of Appropriation Numbers indicating which Appropriation Numbers need to be deleted or changed. The agency submits the 20 Profile forms to BAM for any new Appropriation Numbers that need to be created relating to new legislation.

3. Agency, using the listing of Appropriation Numbers, fills in the Appropriation Number and accounting information, PCA/Index next to each appropriation bill section reference and returns this spreadsheet to BAM.

4. BAM updates or establishes new 20 Profiles based on information submitted by the agency.

5. Agencies must update PCA/Index with new Appropriation Numbers before the next step can occur.

6. BAM loads appropriations upon receipt of chapter law and allots 10% of the appropriation with Effective Date of 07/01/YY.

7. Agencies submit first quarter allotment plan to BAM.

Control Key

◾ AGENCY – Enter a three-character Agency Code. It must exist in the D02 profile.

◾ APPN YEAR – Enter a two-digit Appropriation Year to identify the appropriation year of the appropriation being maintained.

◾ APPN NO – Enter a five-digit Appropriation Number.

◾ TITLE – Enter a Title of up to 40 characters.

Information

Elements

◾ TYPE – Enter a one-digit Appropriation Type. Must be in the D53 profile with the Table ID of APTY. The State of Oregon’s default value is 9.

◾ GROUP – Enter a two-digit

Appropriation Group code. Must be in the D15 – Appropriation Group

Profile. Valid codes are as follows:

|

1 |

– |

General Fund |

5 |

– |

Other Funds – Non Budgeted |

|

4 |

– |

Federal Funds – Non Budgeted |

|||

◾ LEG SESS – Enter a two-digit Legislative Session. This number should correspond with the legislative session that the appropriation was approved in.

◾ SESS CALL # – Enter a one-digit Session Call # or leave blank. In Oregon, the default for the regular Legislative Session is 0. Any further Special Sessions should be coded consecutively, starting with 1.

◾ ACT BL # – Enter up to a six-character Act Bill #. In Oregon, this number will capture the Chapter Law Number of the appropriation. Chapter Law Number is assigned by the Secretary of State Office. Zero fill to left of Chapter Law Number.

◾ BL LN # – Enter up to a four-character Bill Line Number or leave blank. In Oregon, Bill Line # will capture the section where the appropriation is found in the Chapter Law. Zero fill to left.

◾ RIDER # – Enter a four-character Rider #. In Oregon, this number will capture the Subsection where the appropriation is found in the Chapter Law. Zero fill to left.

◾ PROG CODE – Enter a four-character Program Code or leave blank. If entered, it must be at the same level as the Appropriation Level Program indicator, which in Oregon must be at least level 2.

◾ COMP SRC/GRP – Enter a four-character Comptroller Source/Group if the appropriation is restricted to a certain object or leave blank. If entered, must exist on the D09 – Comptroller Source/Group Profile.

◾ REL APPN – Enter a five-digit Related Appropriation number or leave blank. This number is used to identify the legal level of control where more than one appropriation is established for internal control purposes. If entered, it must exist in the D53 profile with the Table ID of RELA. This element will default to the current Appropriation Number entered. In Oregon, leave blank to default to current appropriation.

◾ APPD FUND I/E – Enter a

one-character Appropriated Fund I/E. This field is used to restrict

appropriation numbers to certain appropriated funds. In Oregon the code of I

will generally be keyed to allow for the relationship to appropriated funds.

Valid codes are as follows:

|

I |

– |

Include |

E |

– |

Exclude |

◾ APPD FUND – Enter a 4-digit D22 – Appropriated Fund Profile Appropriated Fund. In Oregon, the actual Appropriated Fund number associated with the appropriation will be entered. There will be one Appropriated Fund associated with each Appropriation Number.

◾ REV OBJ I/E – Enter a

one-character D10 Comptroller Revenue Object I/E. This field is used to

restrict certain Comptroller Revenue Objects to an Appropriation Number.

|

I |

– |

Include |

E |

– |

Exclude |

◾ REV OBJ – Enter up to 10 four-digit D10 Comptroller Revenue Objects separated with commas or up to five ranges identified with hyphens and separated with commas or a combination of both (limit 50 characters)

◾ EXP OBJ I/E – Enter a

one-character D10 Expenditure Object I/E. This field is used to restrict

certain Comptroller Expenditure Objects to an Appropriation Number.

|

I |

– |

Include |

E |

– |

Exclude |

◾ EXP OBJ – Enter up to 10 four-digit D10 Comptroller Expenditure Objects separated with commas or up to five ranges identified with hyphens and separated with commas or a combination of both (limit 50 characters).

Some of the following elements have default values that will remain if not changed.

◾ APPN INDS – UB – Enter

a one-character Unexpended Budget indicator. This element determines whether

the agency can roll forward unexpended budget authority for cash and budget

into the new year. In Oregon, appropriations and limitations are approved

for each biennium so this indicator would always be set to 1 – Unexpended

budget authority for cash and budget. Capital budgets will have the date

set to the end of the project and expenditures will be made against the

original appropriation, so the value of 1 would apply for these also.

|

0 |

– |

No unexpended budget authority |

◾ CTL TYPE- CASH – Enter a

one-character Cash Control Type indicator. This element determines the type of

control exercised over Remaining Free Budget and Cash Available on a Cash

basis. In Oregon, this indicator will always be set to 1 – Absolute/Fatal

unless the appropriation is Non Budgeted. This will prevent warrants from

exceeding the budget available budget/appropriation less cash expended).

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

◾ CTL TYPE- ACCR – Enter a

one-character Accrual Control Type indicator. This element determines the type

of control exercised over Remaining Free Budget and Cash Available on an Accrual

basis. In Oregon, this indicator will always be set to 1 – Absolute/Fatal unless the appropriation is Non Budgeted.

This will prevent payables from exceeding the budget available

[budget/appropriation less (cash expended plus accrued expenditures)].

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

◾ CTL TYPE- ENC – Enter a

one-character Encumbered Control Type indicator. This element determines the

type of control exercised over Remaining Free Budget and Cash Available on an Encumbered

basis. In Oregon, this indicator will be set to 2 – Advisory/Warning

for the quarters one through seven unless the appropriation is Non Budgeted.

The 2 will provide a warning when an encumbrance exceeds the budget

available [budget / appropriation less (cash expended plus accrued expenditures

plus encumbrances)]. During the eighth quarter of the biennium, BAM changes

this indicator to 1 – Absolute/Fatal (except for non-budget and

Capital Construction appropriations). The 1 ensures agencies can not over-expend their restricted appropriations. Valid

codes are as follows:

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

◾ BUDG TYPE – Enter a

one-character Budget Type indicator as follows:

|

A |

– |

Appropriated (Appropriations/Limited) |

◾ REV EXC COL – Enter a

one-character Revenue Excess Collection. This element determines if the

appropriation can be increased automatically for excess revenues collected

above the Estimated Collected Budget. In Oregon, this indicator will always

be set to N.

|

Y |

– |

Yes |

◾ DEP INT IND – Enter a

one-character Depository Interest Indicator. This element determines if the

appropriation can accept depository interest. In Oregon, this indicator is

an informational element only and is not used by any process. The

default value to be used is N – No. If accurate

information is known at the time the profile is established, the indicator will

be entered as the appropriate value. Valid codes are as follows:

|

Y |

– |

Yes |

◾ APPN LEVEL – ORGANIZATION – Enter

a one-character Appropriation Organization Level indicator. It determines the

level of the organization structure at which the appropriation will be

controlled. It controls the posting of the Organization Code to the control key

of the Appropriation Financial Table. Oregon Appropriations are made at the

agency level, but do not require the agency to establish an organization

structure. Therefore, the indicator will be set at 0. Valid codes are

as follows:

|

0 |

– |

No Organization |

◾ APPN LEVEL – PROG – Enter

a one-character Appropriation Program Level indicator. It determines the level

of the program structure at which the appropriation will be controlled. Must be

at the same level of the program code entered in the information section above.

This indicator controls the posting of the D04 – Program Code Profile Program

Code to the Appropriation Financial table. In Oregon, the control has been

mandated at program level 2, so the indicator entered will be 2 on all 20

profiles.

|

0 |

– |

No Program Posting |

◾ APPN LEVEL – OBJ – Enter

a one-character Appropriation Object Level indicator. It determines the level

of the object structure at which the appropriation will be controlled. This

indicator controls the posting of the object to the control key of the

Appropriation Financial table. In Oregon, this indicator will be set to a

default value of 0 – No Object Posting. Oregon does not

appropriate at the object level.

|

0 |

– |

No Object Posting |

◾ ALLOT INDS – SEL – Enter

a one-character Allotment Selections indicator. It determines if this

appropriation will be monitored by period and, if so, monthly or quarterly.

This indicator also determines whether appropriation allotment edits are

performed. If the value is N the allotment edit is not performed,

otherwise the edit is performed. In Oregon, BAM will set these indicators

according to each agency’s criteria for budget monitoring. The valid

indicators are as follows:

|

N |

– |

No Allotments |

M |

– |

Monthly Allotments |

Q |

– |

Quarterly Allotments |

◾ ALLOT INDS – CTL TYPE – Enter

a one-character Allotment Control Type indicator. It determines the severity of

the appropriation allotment edits. The valid indicators are as follows:

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

◾ QTR – Enter a one-character Quarter

indicator. This element and following element are used in reports. The purpose

of these elements is to identify a particular quarter in which a maximum

percentage of the appropriation authority may be expended. In some cases, as a

recommendation, a user agency should not spend more than 33% of the

appropriation authority in a particular quarter. The reason for having these

two indicators is to provide reports to help monitor expenditures. The QTR

element determines if a particular quarter will be monitored for expenditures

to be less than the percentage identified on the PERC Indicator below. The

valid QTR indicators are as follows:

|

1 |

– |

1st Quarter |

4 |

– |

4th Quarter |

◾ PERC – Enter a two-digit Percent. This element is used in conjunction with the Qtr element above. The maximum percentage of an appropriation that may be spent in a particular quarter (as identified by the element above). If percent is not used, 00 must be entered.

◾ PROG/OBJ BUD OBJ LEV IND – Enter

a one-character Program/Object Budget Object Level Indicator. Not Used in

Oregon. Code 0 – No Object Posting will be used as default for

all 20 profiles.

|

0 |

– |

No Object Posting |

◾ AGY BDG INDS – CTL TYPE – Enter

a one character Agency Budget Control Type indicator. It determines the

severity of the Agency Budget edits. Valid indicators are as follows:

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

◾ AGY BUD INDS – OBJ LVL – Enter

a one-character Agency Budget Object Level indicator. It determines the level

of the object structure at which the Agency Budget will be controlled. This

element controls the posting of the object to the control key of the Agency

Budget Financial Table. For example, if the value is 3 the inferred

Object value (6000-personal services associated with the Comptroller Object

6011-base salary) is posted to the control key of the Agency Budget Financial

Table. The valid indicators are as follows:

|

0 |

– |

No Object Posting |

◾ AGY BUD INDS – ALLOT SEL – Enter

a one-character Agency Budget Allotment Selection indicator. It determines if

the Agency Budget will be allotted and, if so, monthly or quarterly. This

element also determines whether agency budget allotment edits are performed. If

the value is N the agency budget allotment edit is not performed;

otherwise the edit is performed. The valid indicators are as follows:

|

N |

– |

Not Applicable |

M |

– |

Monthly |

Q |

– |

Quarterly |

◾ AGY BUDG INDS – ALLOT CTL – Enter

a one-character Agency Budget Allotment Control indicator. It determines the

severity of the Agency Budget allotment edits. The valid indicators are as

follows:

|

0 |

– |

None |

1 |

– |

Absolute/Fatal |

2 |

– |

Advisory/Warning |

|

|

Blank |

– |

Allotment Controls do not apply. If the Allotment Selection Indicator is equal to N, then the Allotment Control Indicator must be blank. |

|||||||

◾ STATUS CODE – Enter a

one-character Status Code. It will default to Active if not entered. It may be

used to inactivate records no longer in use.

|

A |

– |

Active |

I |

– |

Inactive |

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format). It identifies when the record becomes effective. This field can be left blank; it will default to the current date and cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format) or leave blank. EFF END DATE identifies when the record is no longer effective. In Oregon, the Effective End Date will vary on the type of appropriation. This date is also determined by the State policy for year end closing procedures. Currently, the date will usually be six months past the end of the biennium, to allow for agency year end closing. The date will be different for capital projects where the official End Date will equal the end of the project plus any closing time adjustment – maximum of six years.

Example:

|

S020 UC: 10 STATE OF OREGON 04/04/14 10:10 AM |

|

LINK TO: APPROPRIATION NUMBER PROFILE PROD |

|

|

|

AGY: 101 APPN YEAR: 15 APPN NO: 45454 EDUCATION FUND |

|

|

|

APPROP - TYPE: 9 GROUP: 06 LEG SESS: 76 SESS CALL #: ACT BL #: 00XFER |

|

BL LN #: 0000 RIDER #: 0000 PROG CODE: COMP SRC/GRP: REL APPN: 46101 |

|

|

|

I/E (I=INCLUDE, E=EXCLUDE) |

|

ENTER ONE FUND WITH UP TO 10 COMP OBJS SEPARATED WITH EITHER "-" OR ",". |

|

APPD FUND I 4400 , |

|

REV OBJ I 0000 - 2999 , |

|

EXP OBJ E 3000 - 8999 , |

|

|

|

APPN INDS- UB: 1 CTL TYP- CASH: 1 ACCR: 1 ENC: 2 BUDG TYPE: A REV EXC COL: N |

|

DEP INT IND: N APPN LEVEL- ORGANIZATION: 0 PROG: 2 OBJ: 0 |

|

ALLOT INDS- SEL: Q CTL TYP: 1 QTR: N PERC: 00 PROG/OBJ BUD OBJ LEV IND: 0 |

|

AGY BDG INDS- CTL TYPE: 0 OBJ LVL: 5 ALLOT SEL: N ALLOT CTL: |

|

STATUS CODE: A |

|

EFF START DATE: 07012013 EFF END DATE: 12312015 LAST PROC DATE: 10312013 |

|

Z06 RECORD SUCCESSFULLY RECALLED |

|

|

|

F1-HELP F3-DEL F5-NEXT F9-INT F10-SAVE F11-SAVE/CLEAR ENTER-INQ CLEAR-EXIT |

21

Index/PCA Relationship Profile

The 21 profile is used to ensure that organizational structures and program structures are not combined incorrectly. This profile is Agency maintained.

Agencies who use both Indexes and PCAs, may need to define guidelines to use when choosing Indexes and/or PCAs for a profile set up or an online transaction. The 21 Profile would be used to define what would be allowed.

Control Key

◾ AGENCY – Enter the three-character Agency Code. It must exist in the D02 profile.

◾ APPN YEAR – Enter a two-digit Appropriation Year to identify the appropriation year that the Index/PCA are related to.

◾ INDEX – Enter a five-digit Index Code. It must be entered as either a wild card or a valid code in the 24 profile. Refer to the explanation of wild card below in the definition of PCA.

◾ PCA – Enter a five-character Program Cost Account Number. The PCA must be entered as either a wild card or a valid code in the 26 profile. Wild card means the user can select a range of PCAs by entering an asterisk (*) instead of the exact PCA code. For example, the user may wish for the PCA relationship to be all PCAs in the 50000’s, the user would enter 5****. The asterisks must always come after the number. They can not be separated by a number (e.g. 5**1*).

Information

Elements

◾ TITLE – Enter a Title of up to 40 characters.

◾ STATUS CODE – Enter a

one-character Status Code. It will default to Active if not entered. It may be

used to inactivate records no longer in use.

|

A |

– |

Active |

I |

– |

Inactive |

◾ EFF START DATE – Enter the eight-digit Effective Start Date (MMDDYYYY format). It identifies when the record becomes effective. This field can be left blank; it will default to the current date and cause the record to be immediately available.

◾ EFF END DATE – Enter the eight-digit Effective End Date (MMDDYYYY format) or leave blank. EFF END DATE identifies when the record is no longer effective.

Example:

|

S021 UC: 10 STATE OF OREGON 04/04/14 10:14 AM |

|

LINK TO: INDEX/PCA RELATIONSHIP PROFILE PROD |

|

|

|

AGENCY: 333 (MUST BE IN D02 AGENCY PROFILE) |

|

|

|

AY: 14 |

|

|

|

INDEX: 5**** (MUST BE IN 24 INDEX CODE PROFILE) |

|

|

|

PCA: 5**** (MUST BE IN 26 PROGRAM COST ACCOUNT PROFILE) |

|

|

|

TITLE: EASTERN OREGON TRAINING CENTER |

|

|

|

STATUS CODE: A |

|

EFF START DATE: 04012014 EFF END DATE: LAST PROC DATE: 04142014 |

|

Z07 NEXT RECORD SUCCESSFULLY READ |

|

|

|

F1-HELP F3-DEL F5-NEXT F9-INT F10-SAVE F11-SAVE/CLEAR ENTER-INQ CLEAR-EXIT |

22

Cost Allocation Profile

The 22 profile controls the cost allocation process within the system. All allocation information related to the indirect cost pool is contained in this profile. The key to the 22 profile identifies the indirect cost pool to be allocated. This profile is Agency maintained.

Control Key

◾ AGENCY – Enter a three-character Agency Code. It must exist in the D02 profile.

◾ CA TYPE – Enter a one-character Cost Allocation Type. It must exist in the 23 – Cost Allocation Type Profile.

◾ INDEX CODE – Enter a five-digit Index Code. It must exist in the 24 profile, or enter 00000. If costs are to be allocated based on organization, (i.e. when the 25 profile CA-BY-INDEX is 2), a valid Index code is required. For Cost Allocation on a programmatic basis only, (i.e. when the CA-BY-INDEX is 1, 3 or 4), enter 00000 (zeros).

◾ PCA – Enter a five-digit Program Cost Account number. It identifies the indirect cost pool to be allocated. A PCA number is always required regardless of the allocation method and it must exist in the 26 profile.

◾ APPN YEAR – Enter a two-digit Appropriation Year.

Information

Elements

◾ TITLE – Enter a Title of up to 40 characters.

◾ PCA TYPE – Enter a one-digit

Program Cost Account Type. It identifies the PCA as indirect cost or indirect

variance cost. Identifies the PCA as indirect costs or indirect variance costs.

Valid types are as follows:

|

2 |

– |

Indirect Cost. Identifies Indirect PCAs (cost pools) that are

allocated. |

◾ SEQ – Enter a one-digit Cost Allocation Sequence indicator of 1 – 9. Identifies the step-down sequence when this PCA is to be allocated. For a single-step distribution, code a 1. When a multiple-step-down allocation is required, code the numeric value indicating which step during the allocation process this PCA is to be allocated. A multiple step allocation is required when allocating from one indirect PCA to other indirect PCAs which, in turn, will also be allocated.

◾ VAR – Enter a one-digit

Variance Allocation as follows:

|

1 |

– |

Do not allocate the variance except at year end (Standard Methods, PCA type 2, 3) |

||||||

|

2 |

– |

Allocate whenever the variance allocation is run (Standard Methods, PCA type 2, 3) |

||||||

|

3 |

– |

Do not ever allocate (Actual Methods, and/or PCA type 2). Variance allocation indicators 1 and 2 indicate whether any variance remaining in the Indirect Cost Pool is allocated during a variance allocation run. The variance allocation is run when the 25 profile Run Type equals: |