The cost to provide your retirees with a PERS pension is made up of your PERS contributions plus other fees and charges.

This webpage explains the potentially avoidable fees and charges that can increase your costs.

To learn about programs designed to help employers reduce their contribution rate, go to the

Employer Rate-Relief Programs webpage.

To learn more about the different charges that can appear on your statement, read employer reporting guide 26, Understanding Your Statement.

Your PERS contributions

To cover the cost of your employees’ future retirement benefits, you pay money to PERS, called contributions, on a

schedule that aligns with your pay periods (e.g., monthly, biweekly). The amount you pay is your

contribution rate percentage

multiplied by the subject salary that your qualifying employees earned. This calculation is done

automatically by Employer Data Exchange (EDX, PERS’ pension administration system) based on the data you report.

The Oregon Legislature often modifies the laws that govern PERS. Some of these modifications are intended to slow the

growth of employers' contribution rates. Learn more on the Legislation Impacting PERS webpage.

PERS has programs designed to help employers reduce their contribution rate. Go to the

Employer Rate-Relief Programs webpage.

Other charges

Prior-year earnings: Reports that are successfully submitted by official year-end (March 5 of the following year)

receive earnings (if any) paid by the PERS Board. For reports that are not submitted by year-end, your organization is

invoiced for the earnings. This charge is called prior-year earnings.

Penalties: You can incur a penalty for the following:

-

Late report: submitted four or more business days after the end of each reporting period. Regular reports must be in

“released” status in EDX to be considered received.

-

Late payment: paid six or more business days after the statement date.

-

Using a payment method other than Automated Clearing House: Learn more about paying your invoice in

employer reporting guide 27, Paying Your Invoice

.

Benefit Equalization Fund admin fee: Learn about this fee on EDX Invoice Questions.

State and Local Government Rate Pool (SLGRP) charges: The SLGRP has rates that ensure no member is unfairly subsidizing

the unfunded actuarial liability (UAL) rates of other employers in the employer pool. These additional rates are

transition surplus or transition liability rate and the pre-SLGRP pooled liability rate. Learn about these rates in the

Guide to Understanding Your Rate, “Employer Pool” section.

Factors that can reduce your PERS costs

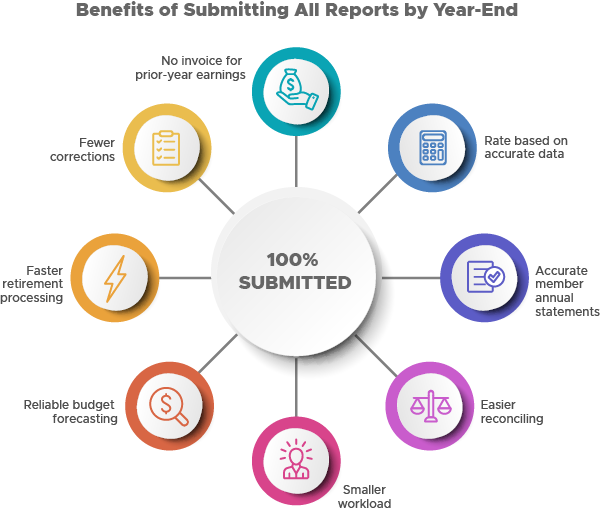

Submitting reports correctly and on time: Reports that are successfully submitted by official year-end (March 5 of the

following year) receive earnings (if any) paid by the PERS Board. For reports that are not submitted by year-end, your

organization is invoiced for the earnings. Submitting on time also saves on rework.

Paying invoices on time: Paying your invoices on time avoids potential late fees.

Employing working retirees: PERS retirees are allowed to return to work for a PERS-participating employer

(with restrictions). Because working retirees don’t earn any additional PERS benefits, the contributions you pay on their

wages directly reduce unfunded actuarial liability (UAL).

Factors that can increase your PERS rate

Unfunded actuarial liability (UAL): Some employers pay a higher percentage to cover past debt to the system or

insufficient payment to the system caused by surprise liabilities. This is called unfunded actuarial liability, which is

a normal part of pension systems.

Police and fire employees: Employers pay a higher rate for police and firefighters than for general service employees.

This is because police and firefighters earn more generous retirement benefits and are eligible to retire at an earlier

age than general service employees. Read about job classifications in the “EDX Job Class Codes” quick-reference guide.

Tier One and Tier Two members: Employees who became PERS members before August 28, 2003, are members of Tier One or Tier

Two, PERS’ most generous tiers. Employers pay a higher rate for these employees than for members of PERS’

third tier, Oregon Public Service Retirement Plan (OPSRP). As more employees retire under OPSRP and fewer under Tier One/Tier Two,

rates should decrease.

Estimate future contribution rates

PERS’ Employer Rate Projection Tool enables you to estimate your organization’s potential employer contribution amounts

and rates over the next several biennia. You may also use the tool to determine the potential impact of establishing a

new side account. The tool provides estimates and is for planning purposes only.

Resources

Guide to Understanding Your Rate

Guide to Understanding Unfunded Actuarial Liability (UAL)

Guide to Understanding Pooling:

Contact PERS Actuarial Services for insight into factors that are driving up your rate.

Schedule some time with your Employer Service Center representative for help with cleaning up suspended reports.