This webpage lists resources you can share with:

- New employees to help them understand their PERS benefits.

- Near-retirement employees to help them understand the retirement process.

You can also send new employees to the

Welcome to PERS website.

PERS retirement benefits

The Public Employees Retirement System (PERS) provides qualifying public employees a pension and an Individual

Account Program (IAP) account that provide income during retirement. Some employers also offer the Oregon

Savings Growth Plan, a deferred-compensation savings plan. These benefits are defined below.

PERS also offers a healthcare plan for retirees (see PHIP below).

PERS functions through the partnership of three state entities: the Oregon Legislature, Oregon State Treasury,

and PERS, the agency. Watch the video "How Does PERS Work?"

to learn how PERS is run.

Additional/different benefits

Certain employers offer a slightly different benefits package, including Oregon Health and Science University

(OHSU),

SAIF, Oregon State Bar, Oregon

Legislature, and Oregon Judicial Department. Contact these employers for details.

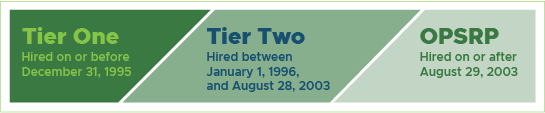

PERS programs and earning benefits

PERS members are in one of three programs, depending on when they first became a PERS member:

- Tier One.

- Tier Two.

- Oregon Public Service Retirement Plan (OPSRP).

Tier One and Tier Two are closed to new members; all new PERS members join OPSRP. (Judges have their own

program.) Learn more:

PERS pension

A pension provides monthly payments for life. Learn more about the PERS pension on the employers’

About the PERS pension webpage.

PERS Individual Account Program (IAP)

A portion of every active PERS member’s salary is contributed to their IAP account, which is invested to

increase in value until the employee accesses the account at retirement. Some employers cover the 6%-of-salary

contribution for their employees.

Earning benefits

Qualifying position

In general, an employee must work 600 hours or more per calendar year to earn PERS benefits. They must work in a

qualifying position (for the same employer) for six months before they begin earning benefits (called “wait

time”).

Job classification

Employees of PERS-participating employers are placed into one of eight job classifications based on the type of

work they do (job classes are listed and defined in the

Job Classification Codes quick-reference guide). Classes have different rules, retirement

eligibility requirements, and even different benefits. Refer to

employer

guide 1,

Overview of PERS, appendix A, for the special benefits of the five most-common job classes.

Oregon Savings Growth Plan (OSGP)

OSGP (if your agency participates): This optional deferred-compensation savings plan is another option for

employees to save more for retirement. Learn more on the

OSGP Employer Benefits

webpage.

PERS Health Insurance Program (PHIP)

PHIP offers both Medicare and non-Medicare health plans to eligible PERS

retirees, spouses, and dependents.

Information and forms

Information and forms for new employees

Information for employees nearing retirement

PERS contact information

PERS contact information for members, members' families, retirees, beneficiaries, and alternate payees

Member Services

Phone: 888-320-7377

Phone hours: 8:30 a.m. to 5 p.m., Monday through Friday

Member Services Submit a Question form

PERS contact information for employers

Employer Service Center

Phone: 888-320-7377; select option 4 to reach ESC

Phone hours: 8:30 a.m. to noon, Monday through Friday

Employer Support email

Staying informed

How PERS members stay informed

When to reach out to PERS

The PERS Member Journey infographic shows when

members need to engage with PERS throughout their career.

Member annual statements

Every year, all PERS members receive a statement of their retirement pension and account balances. To understand

the statement, members should read

Member Annual Statement FAQs.

Email list

To sign up to receive news and updates from PERS, go to the

PERS GovDelivery sign-up webpage,

log in by entering your email address, and choose if you would like to receive news by email, text message, or both.

Then select the topics in which you are interested. Members can change their subscriber settings at any time by going to the

PERS GovDelivery Preferences tab.

How PERS employers stay informed

Employers are signed up for PERS-employer emails automatically through their EDX account.

Do not unsubscribe; the mailing list gets you the monthly employer newsletter and important

news and announcements sent by email.

Yor employees, however, are not automatically signed up for PERS emails. To encourage your employees to sign up,

print the posters below and hang them in a common area. You can also email them to remote employees. They

include a QR code that you can scan with your phone camera to open the GovDelivery website and opt into emails

from PERS.

Right-click (or control+click on a Macintosh) any or all posters below to download now. Available in letter size

(8.5"x11") and legal size (8.5"x14").

For letter size (8.5x11), select one of the following:

For legal size (11x17”), select one of the following: