Members that earn more than the

current monthly salary threshold and are therefore

subject to the Senate Bill 1049 Member Redirect are eligible to elect to make additional voluntary, after-tax

contributions to make a full 6% contribution to their Individual Account Program (IAP) account.

Starting IAP voluntary contributions

Step one

Log into your

OMS

account.

Don't have a login?

Click Open a New Account on the login page and

follow the prompts. Once you have created your account, use your new User ID and Password to log into

OMS.

Need help?

Find resources at the bottom of this page.

Step two

Click the

Member link listed under

Account Type.

Step three

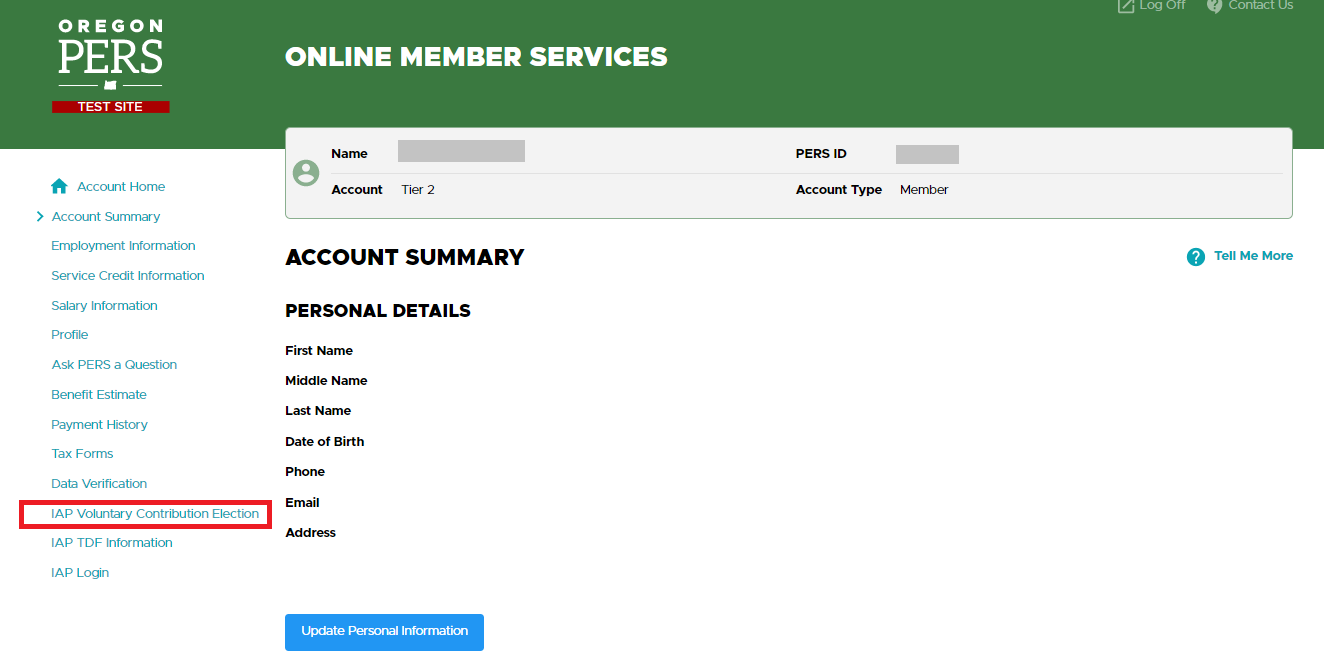

Click the

IAP Voluntary Contribution Election link in the

Site Navigation sidebar, or the

Update IAP Voluntary Contribution Election link within your

Account Summary page.

Step four

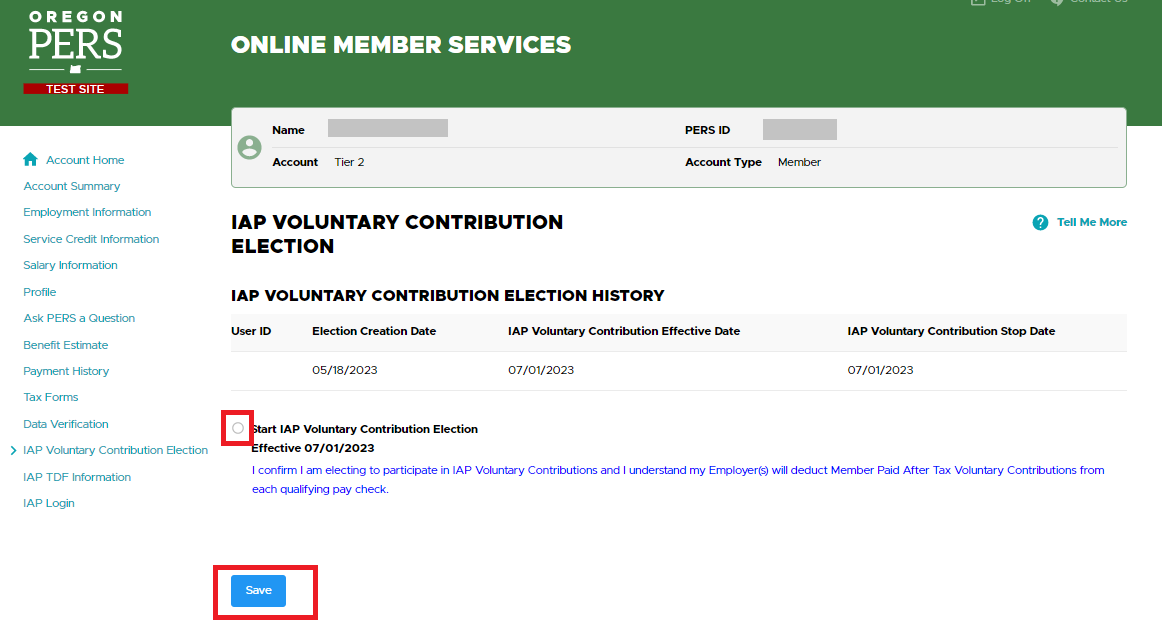

You are now on the

IAP voluntary contribution election page.

From this page, you can:

Click the appropriate radio button and click

Save to begin making IAP voluntary contributions as of the effective

date provided.

An example of electing voluntary contributions on a go-forward basis. The effective date will always be at

least one month following your request date.

An example of electing voluntary contributions on a go-forward basis. The effective date will always be at

least one month following your request date.

Step five

You will receive a confirmation message in blue if you successfully completed your election.

The effective date for your election also will display on your

Account summary page.

Stopping IAP voluntary contributions

Step one

Members also may request to end their IAP voluntary contributions through

OMS. You also can submit a

paper form to

stop voluntary contributions.

From the

IAP voluntary contribution election page, select

Stop IAP voluntary contribution election, and click

Save to discontinue making voluntary IAP contributions.

Step two

You will receive a confirmation message in blue if you successfully completed your discontinuation request.

Review your IAP voluntary contribution election

You can view a record of your IAP voluntary contribution elections on the

View/Update IAP voluntary contribution election page.

Important information about IAP voluntary contributions, your employer’s role, and

effective dates

By electing to make IAP voluntary contributions, you authorize your employer to withhold additional after-tax IAP

contributions equal to the amount redirected to your Employee Pension Stability Account (EPSA). Learn more about the

redirect and EPSA for

Tier One/Tier Two or

OPSRP members.

PERS will provide your employer(s) with your IAP voluntary contribution effective start and – if later requested –

discontinuation dates. Your employer will start and stop payroll deductions as soon as possible.

Your “effective date” to start or stop voluntary contributions works as follows:

- If your election or discontinuation request is received on the

first day of a given month, your effective date is the first day of the

next month.*

- If your election or discontinuation request is received on or after the

second day of a given month, it will take about two months to go into effect, with the

effective date being the first day of the

second month.*

Note that if you elect voluntary contributions but later discontinue them, voluntary contributions will continue to

be made to your IAP until the effective date is reached for your discontinuation request.

If you have questions about deductions or believe your employer is not correctly withholding your after-tax voluntary

contributions, you must contact your employer, which is usually your payroll or human resources department.

*Example: If your election or discontinuation request is received on October 1, your effective date would be

November 1. But if you make your election or discontinuation request on or after October 2, your effective date

would instead be December 1.

Additional resources

Note: As PERS works to modernize online access for members, please use Internet Explorer in

compatibility mode when logging into your OMS account. Other web browsers may experience functionality issues.

Return to the

Senate Bill 1049 information for members webpage.

In compliance with the Americans with Disabilities Act (ADA), PERS will provide documents on this page in an

alternate format upon request. To request a document in an alternate format, call 888-320-7377 (toll free) or TTY

503-603-7766.