Every year, PERS publishes two types of actuarial valuation reports:

- A system-wide report assessing the health of the system as a whole.

- Individual reports for nearly every PERS-participating employer.

The reports are calculated and created by the PERS consulting actuary Milliman based on information they gathered the

previous year.

- Valuations published in

odd years are advisory. They do not set contribution rates; instead, they show what your rates

would be if they were set based on this valuation.

- Valuations published in

even years are rate-setting. They show what employers' new contribution rates will be for the

next biennium starting on July 1.

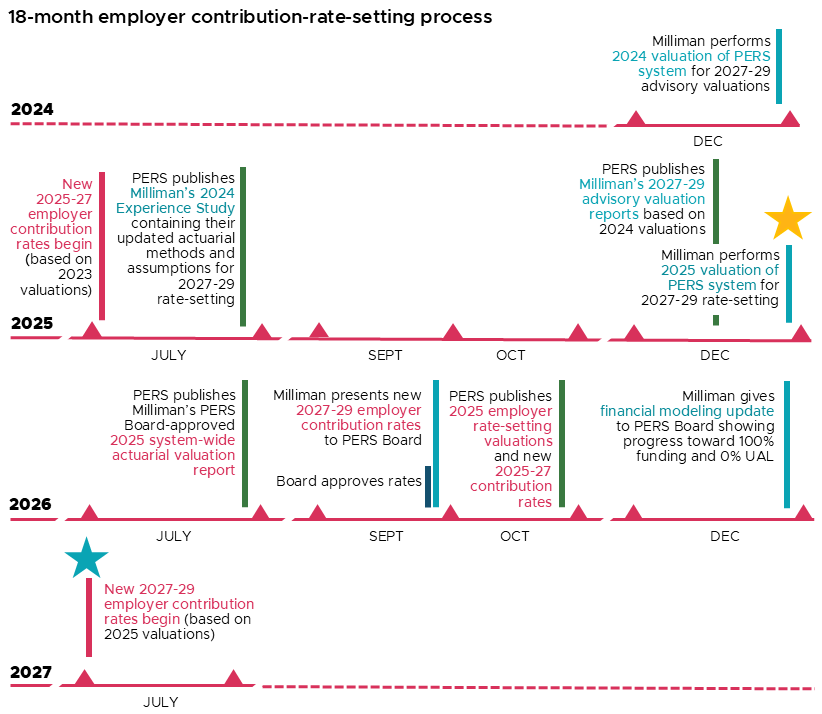

Rate-setting process

Rate-setting is an

18-month process. Rates are set based on the valuation from the previous odd year.

How reports are organized

Employer actuarial valuation reports are grouped together into large files called zip files. You need to download

the zip file that contains your organization’s report and delete the rest of the file.

The valuation zip files are organized like this:

Independent employer valuations are in one zip file.

Independent employers are those who do not belong to the State and Local Government Rate Pool or School

District Pool.

State and Local Government Rate Pool (SLGRP) valuations are separated into three zip files, grouped by

employer number.

State agencies, public universities, and other statewide entities* do not receive separate valuations; they

refer to the valuation for employer #1000.

- School District Pool valuations are in one zip file. School districts that do not have side accounts do not

have individual valuations; they refer to the valuation for employer #3000.

*Other statewide entities include semi-independent agencies, boards, commissions, and public corporations.

Instructions for downloading reports

To download an actuarial valuation report:

-

Click the name of the zip file below that contains the valuation report.

-

Save the zip file to your computer or server. If it automatically saved, check your Downloads

folder to locate the downloaded zip file.

-

Double-click the file to open it (or you may need to extract the zip file, depending on your

operating system). Scroll through the list of PDF files (or use the search field) to find the valuation you

need.

-

Save the PDF file to a folder on your computer or server.

-

Delete the zip file.

2024 actuarial valuation reports

Independent employers*

School districts**

SLGRP ER # 1000-2245

SLGRP ER # 2247-2659

SLGRP ER # 2660-2999

System-Wide 2024 Actuarial

Valuation Report

*Employers who are not part of the SLGRP.

**School districts without side accounts should reference the valuation for ER # 3000, under "School

Districts."

Find

previous years' valuations.

Return to the

Actuarial & Financial Information for

Employers webpage.