Q1: What is data verification?

Q2: Why do only local-government employers list work-period dates?

Q3: How do I calculate unused sick leave?

Q4: Why do I have to wait until the next business day to see if my reports posted

successfully?

Q5: How do I report Paid Leave Oregon contributions and payments?

Q6: What are the criteria for determining if an employee is eligible to earn benefits?

Q7: What are subject wages?

Q8: What is hire intent and how do I determine it?

Q9: How do I determine if an employee is qualifying for a partial year?

Q10: How do I report an employee's death?

Q1: What is data verification?

An employee who is within two years of retirement can request a data verification to ensure that the employment

history information PERS has on record for them is accurate.

When you receive a Data Verification Work List request, it is imperative that you complete it before the 30-day

deadline. If you miss the deadline, you cannot make changes to the employee’s employment history, which could affect

the accuracy of the retirement benefits your employee has earned.

Learn more

To learn the employee process for requesting a data verification, go to the

Data Verification webpage.

For employer instructions on participating in a data verification, read

employer

reporting guide 19

Completing Work List Requests.

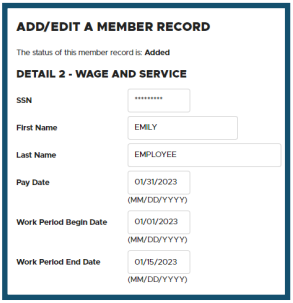

Q2: Why do only local-government employers list work-period dates?

When creating a Detail 2 wage record in EDX, local government employers must always fill in the Work Period Begin and

Work Period End fields when reporting wages, hours, and contributions. Why is this?

Background

The reason goes back to House Bill 3262, passed in 2005. Section 33 of this bill changed the definition of final

average salary for Tier Two and OPSRP pension program members from “earned when earned” to “earned when paid.”

The local government coalition opted out of the change, preferring the earned-when-earned method of reporting salary.

EDX was already programmed to accept salary entries as earned when paid. Therefore, EDX was updated to add the Work

Period Begin and Work Period End fields to enable local government employers to report salary as earned when earned.

Definition

Local government employers can be identified by a PERS employer number in the 2000-2899 range. According to Oregon

law, “a ‘local government’ means all cities, counties, and local service districts located in this state, and all

administrative subdivisions of those cities, counties, and local service districts.”

Requirements

- Local government employers always use Work Period Begin/End Dates on Detail 2 wage records.

- Other types of employers, such as schools, should not fill in these fields.

- Local government employer reporters must use two Detail 2 records to report wages, hours, and contributions for

pay periods that cross monthly boundaries (i.e., begin in one month and end in the next). Work period begin and

end dates will not cross monthly boundaries.

Q3 How do I calculate unused sick leave?

The unused sick leave program, established by Oregon Revised Statutes (ORS) 238.350 and 238.355, has been around for

nearly 50 years. However, confusion, incorrect calculations, and inconsistent reporting persist.

To help employers understand how to properly calculate an employee’s unused sick leave hours, PERS has outlined the

step-by-step process in

employer

reporting guide 17

Calculating Unused Sick Leave Hours at Termination or Retirement.

About the unused sick leave program

This program applies only to Tier One and Tier Two members who work for an organization that participates in the

program. The program allows these employees to be compensated for a portion of their accumulated unused sick leave

in the form of increased retirement benefits upon regular service or disability retirement.

Employer participation is optional, but once your organization begins the program, it cannot withdraw.

How the program affects Tier One/Tier Two benefits

Half of the value of a Tier One and Tier Two employee’s net unused sick leave hours will be included in the

calculation of their final average salary. These additional hours increase their retirement benefits under the Full

Formula and Formula Plus Annuity benefit calculations. The hours do not impact the Money Match calculation because

final average salary is not a factor in this calculation.

OSPRP members

The program is not available to OPSRP employees. How their unused sick leave is handled upon termination depends on

their employer’s policy. If the employer’s policy allows for unused sick leave to be “cashed out,” these funds are

considered non-subject salary for PERS purposes (i.e., no employer contributions are due on that income).

Unused sick leave hours are not used in the calculation of an OPSRP pension benefit, but employers still need to fill

in the Unused Sick Leave Hours field on the Detail 1 termination record. Employers should report “0” unused sick

leave hours for OPSRP members terminating employment.

Learn more

To find out if your organization has elected to participate in the unused sick leave program or to request to

participate in the program, contact your

ESC representative.

Q4: Why do I have to wait until the next business day to see if my reports posted successfully?

EDX processes all the information submitted each day in a “batch run” that takes up to 12 hours to complete. During

the batch run, EDX analyzes reports to ensure the data was reported correctly. If it finds errors in a record, it

flags the record with an error message and lists it under unposted records for you to correct and resubmit. If it

finds no errors in a record, it records the employee data in PERS’ system and generates an invoice in your Unbilled

Activity Statement.

EDX is unavailable during batch runs. Batches occur Monday through Friday from 9:00 p.m. to 6:00 a.m. and on weekends

from 4:00 p.m. to 6:00 a.m. The system conducts a long batch run at the end of each month and whenever EDX receives

a system update.

Q5: How do I report Paid Leave Oregon contributions and payments?

Note: The information in this FAQ is subject to change.

Overview of reporting payments

Only payments paid directly by the employee’s employer are reported to PERS. This includes:

- Payments from an employer-run PLO plan.

- Sick leave, vacation, and other accrued paid time off provided by the employer.

PLO payments from a state-run or third party-run PLO program are not reported to PERS.

Overview of reporting employee’s leave

Report your employee’s PLO leave to PERS as a family leave only if it meets both of the following requirements:

- It consists of at least 11 business days in a calendar month. Days do not have to be consecutive but must add

up to at least 11 days off work.

- Employee is not receiving any pay from the employer, such as employer-paid leave, sick leave, vacation,

holiday, or compensatory time. Any day for which an employee receives pay from the employer does not qualify for

a leave without pay (LWOP).

Note: PERS members do not earn service credit for any month in which they are reported as on LWOP.

For detailed reporting instructions, read

employer

reporting guide 13,

Family and Medical Leave.

Q6: What are the criteria for determining if an employee is eligible to earn benefits?

Criteria 1: They must be eligible to be a PERS member.

The following employees cannot be PERS members:

- Independent contractors. (Refer to

Oregon Revised Statute (ORS) 459-010-0032(2).)

- Inmates of a state institution.

- Student employees (e.g., work study program). (Refer to

ORS 459-005-0025.)

- People in the United States on a training or education visa.

- Employees of employers who actively participate in an Optional Retirement Plan (ORP) or alternative retirement

plan.

- PERS retirees.

- Judges (they have a separate PERS plan).

Criteria 2: They must successfully complete a six-month wait time.

New employees who are not PERS members need to work for six months before they become a PERS member, called their

six-month waiting period. To successfully complete the waiting period, the employee must do the following:

- Work in a “qualifying position” (i.e., when you reported the new hire to PERS, you assigned them a job status

of Qualifying New Hire because the position requires at least 600 hours of work a year). A qualifying position

can also be established when an employee works more than 600 hours/year with one or more employers.

Complete six months of continuous employment with one employer

Note: If an employee takes an official period of leave without pay (LWOP) during their

waiting time, the wait-time period is extended by the length of the leave.

- Still be employed at the beginning of the first day following the waiting period with the same employer for

whom they were working at the start of the waiting period.

Note: Report wages as subject salary for the employee during their wait time. EDX knows the

employee is completing a wait time and will not charge contributions on their salary until the first day after their

six months ends.

Criteria 3: They must work in a qualifying position or work at least 600 hours/year.

To determine if an employee’s position should be qualifying or non-qualifying (also called “hire intent”), complete

these steps.

Answer this

question:Is this position expected to work 600 hours or more in any calendar year?

Yes — Hire intent for the job segment is

qualifying. Use status code 01 – Qualifying New Hire when you report the new employee.

No — Hire intent for the job segment is

non-qualifying. Use status code 15 – Non-Qualifying Hire when you report the new employee.

Do a status check to find out if a new employee is eligible for contributions from hire,

what membership plan they are in, and if they have elected to participate in voluntary IAP contributions.

Once an employee works 600 hours or more in a year, they qualify for benefits. Employees who work more than

one part-time position can qualify for benefits based on their combined hours.

You have three options for doing a status check:

Q7: What are subject wages?

“Subject salary” means wages that are subject to PERS contributions.

There are two types of PERS contributions that you pay to PERS for your employees who qualify to earn benefits:

- The payments you make toward your employees’ future

pensions (your organization’s contribution rate multiplied by each employee’s subject salary).

- The payments you contribute to your employees’

Individual Account Program (IAP) accounts (6% of their subject salary, which can be paid by the

employee or the employer).

Employee wages are almost always subject salary. However, the PERS system will only charge your contribution rate on

employees who qualify to earn benefits. This could be determined by the status you assigned to your employee when

you first hired them:

- Status code 01 – Qualifying New Hire.

- Status code 15 – Non-Qualifying Hire.

It can also be determined by how many hours they work in a year. In general, positions that work more than 600 hours

in a full calendar year qualify for benefits (i.e., they are qualifying). Positions that work less than 600 hours in

a full calendar year do not qualify for benefits (i.e., they are non-qualifying).

Employer Data Exchange (EDX), the PERS reporting system, calculates your pension contribution and includes it on your

invoice. It does not calculate your IAP contribution, so you must enter that in the appropriate field in a Detail 2

wage record.

Because EDX automatically charges your contribution rate on a qualifying employee’s wages, you need to tell the

system if the employee receives a payment that is not subject to contributions. For example, a hiring bonus,

vacation cash-out, or incentive pay. For these special payments, refer to the

Payment Categories chart to determine if a

payment should be added to the employee’s subject salary or reported separately in the Non-Subject Salary field on a

Detail 2 wage record.

Q8: What is hire intent and how do I determine it?

Hire intent refers to your expectation of how many hours an employee will work in their position for you and, thus,

whether their position qualifies to earn PERS benefits. Hire intent is established when you report a new hire and

assign them a status of Qualifying New Hire or Non-Qualifying Hire.

If the employee changes from their original hire intent by moving into a position requiring more or fewer hours, you

need to:

Submit a Detail 1 record to terminate them from their original job. This ends that “job segment” in EDX.

Submit a second Detail 1 record to hire them into the new job segment.

If they are not changing their job but merely changing the number of hours it requires, you still need to terminate

them from their first job and hire them into the second. This creates separate job segments in EDX.

Q9: How do I determine if an employee is qualifying for a partial year?

A full year of employment begins on January 1 and continues through December 31. During a full year of employment, an

employee must work 600 hours or more for one or multiple employers to be considered “qualifying”; that is, for their

hours and wages to earn PERS benefits and for you to be required to pay contributions on those wages. Anything less

than a full calendar year is considered a partial year. Partial year rules may apply to determine if the year is

qualifying for an employee.

To determine if an employee’s partial year is qualifying or not, follow the instructions in

employer

quick-reference guide "Determining Qualification for a Partial Year".

Q10: How do I report an employee's death?

When an employee dies before retirement, the employee’s family and employer must follow a few important steps to

report the death to PERS and ensure the employee’s account is updated and beneficiary benefits can begin, if

applicable.

Notice to PERS (by family and employer)

- As soon as possible, the employee’s death should be reported to PERS by either the employee’s family, a

representative of the employee’s family, or the employer. (A family member or representative can call PERS

Member Services at 888-320-7377.)

- The family member or rep will need to provide PERS with a photocopy of the long form of the death certificate

and contact information for next of kin. Information can be faxed, mailed, or dropped off at the PERS office in

Tigard.

- The family member or representative should call the member’s employer (i.e., usually their manager or HR

representative) to inform them of their employee’s death.

Report final wages and termination (employer reporter)

- Report the employee’s final wages. It’s important to do this before submitting the termination.

- Report the employee’s death by submitting a Detail 1 record (instructions below). This also closes out the

employment segment.

Completing the Detail 1 record

- Create a new Demographics and Adjustment report (or edit an existing one).

- Add a Detail 1 Member Demographics record. Choose a 10 - Deceased status code. This record does double duty by

posting a death status on the account and terminating the open employment segment.

For detailed instructions, read

employer

reporting guide 15,

Reporting a Termination or Death.