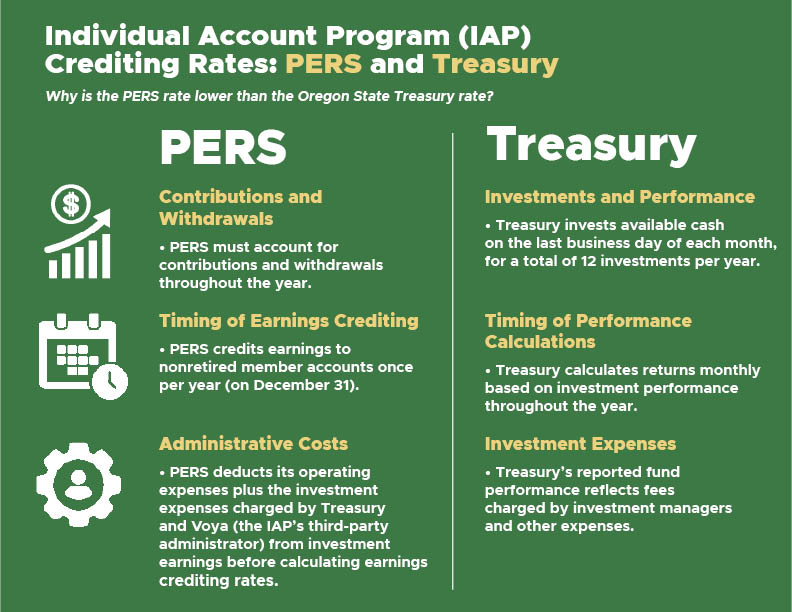

Changes to PERS Individual Account Program (IAP) performance rates published by

Oregon State Treasury (aka Treasury)

are based solely on investment fund performance, while PERS takes into account additional factors to set the final

earnings crediting rates that ultimately get applied to member IAP accounts.

The difference between the Treasury performance rates

and PERS crediting rates can be explained by the way cash flow

impacts crediting rates. For instance, when a member retires during the year, their IAP account is credited earnings

as of the date of distribution of the account balance. The rate applied to the distribution may be higher than the

final earnings crediting rate applied to all member accounts, which means there will be less earnings available for

crediting and therefore a lower crediting rate.

Examples for the following two calculations are provided in the attached Excel spreadsheet:

-

Treasury performance rate calculation — Treasury invests contributions throughout the year and

calculates earnings rates based on investment gains or losses divided by invested funds, which increase monthly

with contributions and decrease with payments to the member, if they’re retired or have otherwise opted to

withdraw their IAP.

-

PERS earnings crediting rate calculation — Earnings are credited by PERS at a fixed point in

time, which is always December 31 of each year. The rate calculated for each target-date fund (TDF) is based on total

investment earnings for that fund minus the agency’s administrative costs and earnings already distributed to

members during the year, divided by the final fund balance as of December 31 each year. Oregon law requires that

earnings be credited to IAP accounts once per year.

While investment risk is the primary driver of TDF rate variances in Treasury performance calculations, another

significant driver of rate variances between target-date funds’ is the effect of deposits (contributions) and

withdrawals (benefit payments) from the fund throughout the year. This activity tends to include more deposits

coming into the later (2060, 2065, 2070) target-date funds as younger members contribute to the fund, and more

withdrawals coming out of the earlier (Retirement Allocation, 2030, 2035) target-date funds as older members retire.

The scale of this activity can vary significantly from year-to-year and fund-to-fund based on decisions made by

members.

For all of these reasons and the effect of administrative expenses, which were approximately 0.12% of the total fund

balance for the calendar year that ended December 31, 2023, the published PERS earnings crediting rates were — and

will always be — lower than the fund performance rates published by Treasury.