What is a Lease Agreement?

A lease is a contractual agreement that enables an agency to use a product (or “property”) for a specific period of time. In exchange, an agency (or “lessee”) remits periodic payments to a supplier or a financial institution for the use of that property.

- An operating lease is one option. An operating lease does not involve the lessee obtaining ownership of the property. The supplier retains ownership, and the lessee obtains the use of the product for a specific amount of time. An operating lease must meet standards set by the federal Governmental Accounting Standards Board.

- A capital lease, also known as a lease-purchase agreement, is a second option. A lease-purchase agreement spreads out the terms of payment for the property, which eases the financial burden of making a large acquisition. The agency is able to use the equipment while making payments, and at the end of the payment period, obtain title to the equipment.

For financial accounting and reporting purposes, a capital lease must include property that meets or exceeds the capitalization threshold of $5,000 at the beginning of the lease, must be non-cancelable and must satisfy any one of the following conditions:

- The lease transfers ownership of the property to the agency by the end of the agreement term.

- The lease contains a bargain purchase option, which allows an agency to buy the leased property during the lease term at a considerably lower price than its fair value on the date the option is exercised.

- The lease term is 75% or more of the estimated useful life of the leased property.

- The present value of the minimum future lease payments at the beginning of the lease, excluding the cost of executing the lease, is 90% or more of the fair value of the leased property.

Agency management is responsible to ensure proper accounting and reporting of capital leases. Agencies that enter into a lease agreement must apply the above criteria to determine if the transaction is an operating lease or a capital lease.

Note: Only the DAS Director is authorized by statute (refer to ORS 283.085 to 283.092) to enter into financing agreements to acquire property for agencies. Refer to

Oregon Accounting Manual 15.60.30 for guidance on accounting and financial reporting for operating and capital leases. Refer to

DAS Other Financing Policies and Procedures for processing and approval of financing agreements.

This section covers lease and capital lease agreements primarily used to finance equipment acquisitions only. Refer to

DAS Leasing Services for State Agencies for information on facilities leasing.

When to Use Lease Agreements

An agency may consider a lease or capital lease agreement as an option to acquire a product, such as technology hardware, that has a significant rate of change and a shorter life cycle, or useful life, than other assets. An agency should examine financial alternatives to acquire needed products and should make its decision on whether to lease or purchase a product by:

- Determining the agency business needs regarding the product.

- Examining the overall asset management processes at the agency.

- Conducting a cost-benefit analysis of the leasing and purchasing alternatives.

The decision over whether to purchase, lease or lease-purchase a product must be made according to the agency’s understanding of how the product will be used. Advantages and disadvantages of each option should be weighed to determine what factors are the most important to the agency. Financial considerations should be included among these factors, however, the agency should also consider its use and management of the product.

For example, an agency may need to arrange for a large number of distributed staff to use dedicated equipment in remote locations. In this case, leasing may be the preferred option, as it would allow the agency to obtain the same equipment for all users, and deploy all the equipment quickly and easily across multiple geographic regions.

An agency’s budget and finance unit can best determine the proper accounting practice based on relevant statutes and agency practices. An agency that plans to evaluate a financing agreement as a potential funding option for a procurement should contact the Capital Finance and Planning Manager in the DAS Chief Financial Office (CFO).

How to Evaluate Type and Process Lease Agreements

To support an agency’s business decision to acquire an item outright or lease the item, the agency should outline the costs to acquire, manage, maintain, and dispose of the item.

Evaluate Type of Lease Agreement

For each lease agreement entered into, the agency must consider the criteria for capital leases to determine whether to classify the lease as an operating lease or capital lease.

Note: Any financing agreement over $100,000 requires approval by the DAS Director and the State Treasurer or their designees.

A provision to transfer ownership from the supplier to the agency should be present in the lease agreement.

If an agency intends to exercise a purchase option, it should consider including a bargain purchase option in the terms and conditions of the lease. The agency should use judgment in determining whether the purchase option price will be a bargain price at the option date. The difference between the option price and the expected fair value must be large enough to support an agency’s decision to exercise the option.

The term of a capital lease is normally fixed and is non-cancelable. For a capital lease agreement, the term must be 75% or more of the estimated useful life of the leased property. If an agency estimates the useful life of property at 60 months and enters into a lease agreement for that property for 48 months, then the agreement has met the criteria for a capital lease agreement.

The concept of present value is crucial to making an equal comparison of costs between purchase, lease-purchase, and leasing options. Present value refers to the cost of future dollars in today’s dollars. A dollar that is available to use in the future is worth less than the same dollar that is available immediately.

When evaluating leasing alternatives, the future dollars that would be expended in a lease or lease-purchase agreement must be converted to their value in present dollars in order to compare the real costs of each option.

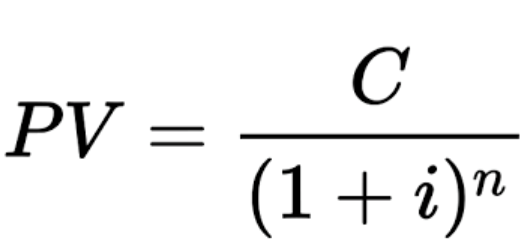

For a capital lease agreement, the present value (PV) of future dollars is determined by the following formula:

Where

C=Total dollar amount

i = Periodic interest rate

n = Number of time periods

A sample cost analysis using present value, based on a 10% interest rate, a five-year lease term and fair value of $345,000 is provided below.Day 1/Year 1 beginning of lease

| 312,740

|

Day 1/Year 1

| 75,000

| -

| 75,000

| 237,740

|

Day1/Year 2

| 75,000

| 23,774

| 51,226

| 186,514

|

Day 1/Year 3

| 75,000

| 18,651

| 56,349

| 130,165

|

Day 1/Year 4

| 75,000

| 13,017

| 61,983

| 68,182

|

Day 1/Year 5

| 75,000

| 6,818

| 68,182

| 0

|

The present value of future lease payments at the beginning of the lease is $312,740. At 90.65% of the fair value of the leased property, the present value of minimum future lease payments meets the criteria for a capital lease agreement.

A lease is considered non-cancelable if there is no provision for an agency to terminate at any time for any reason. Lease agreements commonly contain a fiscal funding clause that allows for the cancellation of the lease if the state does not appropriate the funds necessary to make the required lease payments. In this circumstance, if the chances of the lease being canceled due to non-appropriation are remote, the lease is considered non-cancelable, and meets the criteria for a capital lease agreement.

If a lease agreement is non-cancelable and meets any one of the conditions described in this section, it should be classified as a capital lease. Otherwise, the lease agreement is classified as an operating lease.

Process a Lease Agreement

An agency should process a lease agreement according to the type of agreement and the selected procurement method. If the total value of the lease agreement exceeds the agency’s delegated procurement authority, a requesting agency must submit a purchase request through

OregonBuys or submit an OregonBuys Request to DAS On Behalf Of, the

procuring agency, to conduct the procurement on its behalf.

Elements of a Recommendation for a Financing Agreement

The requesting agency must obtain approval by the DAS Director and the State Treasurer or their designees for any financing agreement over $100,000.

Resource: Submit a

CIS-101 Financing Agreement Form to the CFO for review and approval coordination with the State Treasurer's Office.

The requesting agency should include a detailed list of the assets being acquired that support the principal amount of the financing agreement, including:

- A payment schedule from which interest rates can be verified.

- A copy of the agreement between the state and other parties to the financing. agreement, including provisions regarding tax-exempt status of agreement if applicable.

- A clause confirming that payments by the state under the agreement are subject to appropriation.

In the CIS-101 Financing Agreement Form, the agency should:

- Identify the source of funds used to repay the financing agreement.

- Commit to use best efforts to seek funds and budgetary authority each biennium to repay the financing agreement so long as it is outstanding.

- Commit that the financed property will be used only by state government and only for authorized government purposes unless the agency obtains written consent from the Capital Finance and Planning manager allowing other purposes.

- Certify that assets being acquired are essential to providing governmental services and are free and clear of all liens and encumbrances.

- For tax-exempt financing agreements, commit to assist DAS and the State Treasurer with filing all forms, responding promptly to inquiries and taking any actions necessary to ensure ongoing compliance with tax laws together with an acknowledgment that the requesting agency is responsible for costs related to tax matters including but not limited to bond/tax counsel fees.

- Commit to retain all records relative to financing agreements for three years subsequent to final maturity.