About the Member Redirect program

The Member Redirect program was introduced by Senate Bill 1049 (2019) in 2020 to help control rising employer costs.

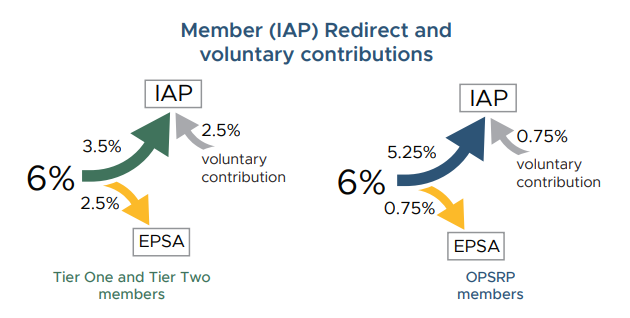

With Member Redirect, a PERS member who earns over a certain amount* per month has a portion of their 6%-of-salary

IAP contribution redirected into an account called an Employee Pension Stability Account (EPSA). The funds in the

account will help pay for the member’s pension at retirement.

Qualifying Tier One and Tier Two members have 2.5% of their salary subject to IAP contributions redirected into

their EPSA and qualifying OPSRP members have 0.75% of their salary subject to IAP contributions redirected.

To qualify, an employee must earn over that year’s monthly salary threshold and work in a qualifying position (i.e.,

one that qualifies to earn PERS benefits by requiring more than 600 hours a year of work).

The redirect occurs automatically; there is no action required by employers unless the employee opts into voluntary

contributions.

*The salary amount is updated each year and listed on the employers' Member Redirect webpage.

Learn more about Member Redirect on the

Member Redirect webpage.

About voluntary contributions

Employees can choose to make an additional, after-tax contribution equal to the amount being redirected into their

EPSA (either 2.5% or 0.75% of salary subject to IAP contributions), allowing their IAP account to continue funding

at 6%.

Starting a voluntary contribution

- Employee logs into Online Member Services and chooses the voluntary contribution option.

- The employer is notified of the employee’s election through an IAP Voluntary Contribution Work List request.

- The employer makes note of the employee’s voluntary contributions amount on the next invoice. It appears in the

IAP section under Invoices as a line item called “IAP Voluntary Contributions.”

- To redeem that amount from the employee’s pay, the employer sets up a payroll deduction to deduct the voluntary

contribution amount from the employee’s paychecks on a member-paid after tax (MPAT) basis.

Stopping a voluntary contribution

- The employee cancels the voluntary contribution in OMS.

- The employer receives a Stop-IAP Voluntary Contribution Work List request.

- The employer stops MPAT deductions on paychecks dated after the effective stop date.

Learn more about voluntary contributions

For instructions on what to do when an employee opts to start or stop making voluntary contributions to their IAP,

including how to run an IAP Voluntary Contribution Report and how to find voluntary contribution charges on your

statement, read

employer

reporting guide 19,

Completing Work List Requests, section “IAP Voluntary Contribution Request.”