The Member Redirect program, introduced by Senate Bill 1049 (2019), eases employer rates by requiring PERS members to contribute to their future pensions. PERS members whose qualifying salary in a month exceeds the monthly salary threshold in effect for that calendar year have a portion of their 6% Individual Account Program (IAP) contribution redirected to their Employee Pension Stability Account (EPSA). Each member’s invested EPSA will help fund their pension when they retire.

Learn more about Employee Pension Stability Accounts.

Redirected percentage

The amount redirected depends on the member’s PERS plan:

- Tier One and Tier Two members — the redirected amount is 2.5% of salary subject to IAP contributions.* The remaining 3.5% is deposited into the member’s IAP account.

- Oregon Public Service Retirement Plan (OPSRP) members — the redirected amount is 0.75% of salary subject to IAP contributions.* The remaining 5.25% is deposited into the member’s IAP account.

*Salary that is subject to PERS pension and IAP contributions and included in calculating PERS retirement benefits is categorized as “subject salary.” Payments that are not subject to PERS contributions nor used in benefits calculation are called “non-subject salary.” Refer to the

Payment Categories chart to find how different types of payments are categorized.

Member Redirect salary threshold

2026 salary threshold: $3,890/month

2025 salary threshold: $3,777/month

2024 salary threshold: $3,688/month

2023 salary threshold: $3,570/month

2022 salary threshold: $3,333/month

2021 salary threshold: $2,535/month

2020 salary threshold: $2,500/month**

**First year of the program.

Voluntary contributions — member signup

PERS members have the option to make up the redirected amount by choosing to make after-tax “voluntary contributions” to their IAP account. Members choose to start and stop voluntary contributions through their Online Member Services (OMS) account. Instructions are listed on the

How to Elect and Update IAP Voluntary Contributions Online webpage.

Voluntary contributions — employer responsibilities

For instructions, go to the

How to Manage an Employee’s Voluntary Contribution webpage.

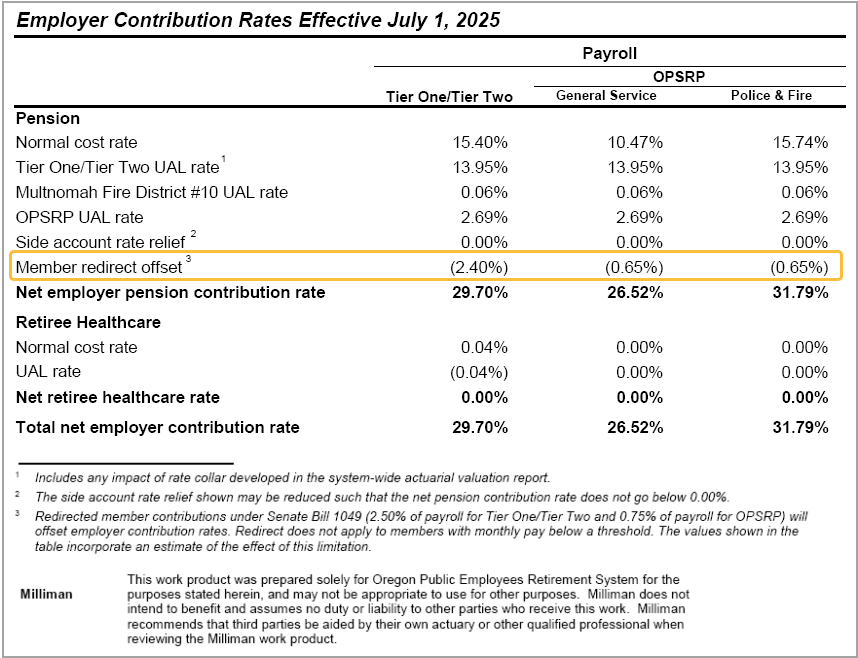

Member Redirect offset

You can see the effect of Member Redirect in the Executive Summary section of your organization’s actuarial valuation, as shown in the sample valuation below.

Resources

Employee Pension Stability Account (EPSA) webpage for members

Tier One/Tier Two members webpage (for employees hired before August 29, 2003)

OPSRP members webpage (for employees hired after August 28, 2003)

How to Manage an Employee’s Voluntary Contribution

Frequently Asked Questions on Voluntary Contributions for Employers

Member Redirect Voluntary Contributions Process Map: Employer View