About the EIF

The Employer Incentive Fund (EIF) program was established by the 2018 Oregon Legislature with Senate Bill 1566.

Then-Governor Kate Brown proposed this measure to provide additional funding for PERS by creating the EIF to match

side account contributions by participating PERS employers.

Employers who apply to open or increase a side account under the EIF program receive a matching deposit of 25% of

their side account deposit. The match is paid from the Employer Incentive Fund, which is a separate fund managed by

Oregon State Treasury that is funded by Oregon Lottery sports betting proceeds.

- The minimum match is $6,250 (25% of the minimum deposit of $25,000).

- The maximum match is either 5% of the employer’s unfunded actuarial liability (UAL) or $300,000, whichever is

greater.

The EIF program is scheduled to sunset on July 1, 2042. After that, any unexpended moneys remaining in the Employer

Incentive Fund will be transferred to the state General Fund.

What is a side account?

When an employer makes a lump-sum payment to prepay all or part of their pension unfunded actuarial liability (UAL),

PERS deposits the money in a special account called a side account. This account is attributed solely to the

employer making the payment and is held separate from other employer reserves. PERS applies the funds toward the

employer’s UAL (i.e., their PERS debt), which reduces the employer’s contribution rate. The payments from the side

account are amortized over a predetermined period (usually 20 years).

For the EIF, if the deposit is $10 million or more, the employer can select a shorter amortization period of 6, 10,

or 16 years.

Employers can establish a side account at any time. Once you establish a side account, you can make up to two

additional payments per side account per year with no additional fees. To learn more, read the

Employer Side Accounts webpage.

2025 — EIF cycle two

All EIF resources allocated on July 1, 2025

All funds for the second cycle of the EIF program were allocated on July 1.

Employers can still apply in case any funds become available. Follow the instructions below in the “EIF

Application

Process” section.

Where did the money go?

Phase one, April 1 – June 30, 2025: Application period for employers with an unfunded actuarial

liability (UAL)

greater than 200% of valuation payroll.

-

Fund starting balance: $39 million

-

Employers who were approved for matching funds: 8

-

Matching funds allocated: $5.7 million

Phase two, July 1, 2025 – all funds are matched: Application period for all employers.

-

Fund starting balance: $33.3 million

-

Employers who were approved for matching funds: 28

-

Matching funds allocated: $33.3 million

What’s next

Successful applicants have until March 31, 2026, to pay their deposit. Anyone who does not pay by 11:59 p.m.

Pacific

on March 31 forfeits their match.

In case an approved employer fails to make their deposit on time or reduces their deposit, PERS Actuarial

Activities

Section will offer those unallocated funds to the next employer or employers on the applicants list. Employers

can

apply until March 31, 2026.

Future cycles

The EIF Program is scheduled to remain active until 2042. As long as the EIF continues to receive income, PERS

will

periodically open new application cycles.

PERS Actuarial Activities Section cannot predict when the next cycle might occur. If sufficient funds become

available, PERS Actuarial will announce cycle three.

EIF application process

-

Prepare to complete the application:

-

Gather the information listed in the EIF application instructions (PDF).

-

Read the EIF fact sheet (PDF).

-

Make sure you meet the EIF qualification criteria explained in the EIF fact sheet, facts 4 and 5.

-

Open the application by clicking this link or copying and pasting it into your browser:

https://www.surveymonkey.com/r/EIF-2025_Application.

-

Carefully fill out the application (finance officers, agency heads, and roles responsible for making financial

decisions only). It is in a survey format, so be sure to:

-

Include the required attachments.

-

Click Submit on the last page. Your application is not submitted until you click Submit.

-

PERS Actuarial Activities Section will let you know the status of your application.

Information and assistance

For more details about the program, read the complete EIF administrative rule:

Oregon PERS Chapter 459

Employer Incentive Fund Program.

If you have any comments, questions, or concerns, email

Actuarial.Services@pers.oregon.gov.

If you do not receive emails from PERS,

sign up for

GovDelivery notifications.

Go to the Employer Rate Relief Programs

webpage.

2019–2023 — EIF cycle one

The first cycle of the EIF closed on March 31, 2023. During the 2022 legislative session, the Oregon Legislature

appropriated $17,250,000 in General Funds to the EIF. When combined with the forecasted $19,500,000 in Sports

Betting funding already anticipated to fund EIF by year-end 2023, these funds provided sufficient matching

dollars to offer a match for each of the 44 waitlisted payments.

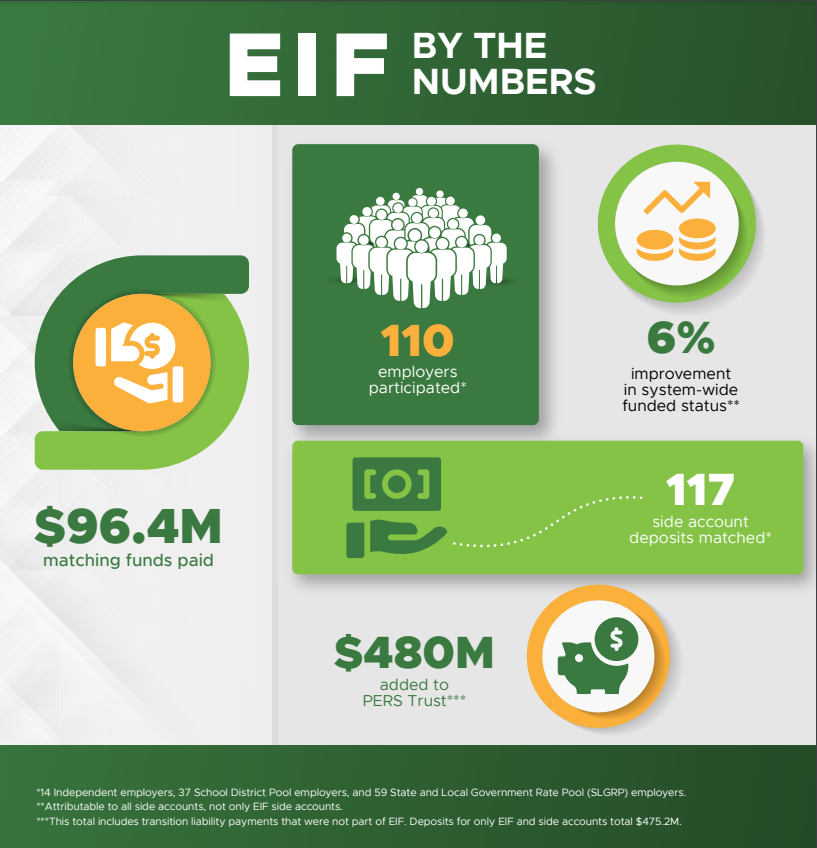

The first cycle was highly successful and financially benefited all participating employers. More than $96

million in matching funds went to 110 employers, causing a 6% improvement in system-wide funded status.

| Funds matched/calendar years |

| 2019 | $41,488,630 |

| 2020 | $23,264,532 |

| 2021* | 0 |

| 2022 | $30,118,737 |

| 2023 | $1,550,000 |

|

Total

|

$96,421,899

|

* No funds were matched because of temporary reallocation of state funds.

Information through November 30, 2023

Information through November 30, 2023

Where did the money go?

School districts

28

| Charter schools

6

|

Cities

30

| Education service districts

3

|

Special districts

26

| Community college

1

|

Counties

13

| State universities

2

|

Information through November 30, 2023

EIF matches for Oregon counties

County

|

EIF match

|

County

|

EIF match

|

Baker | $100,000 | Lake | $442,037 |

Benton | $4,861,723 | Lane | $25,289,732 |

Clackamas | $2,931,690 | Lincoln | $722,565 |

Columbia | $1,144,869 | Linn | $701,184 |

Crook | $200,000 | Malheur | $550,137 |

Deschutes | $7,501,085 | Marion | $2,226,728 |

Douglas | $1,906,184 | Multnomah | $28,248,146 |

Gilliam | $12,500 | Polk | $141,314 |

Grant | $87,500 | Sherman | $600,000 |

Hood River | $409,684 | Union | $62,500 |

Jackson | $4,712,647 | Wasco | $588,034 |

Jefferson | $1,403,671 | Washington | $10,042,189 |

Klamath | $672,030 | Yamhill | $353,750 |