The Oregon Public Employees Retirement System (PERS) was established in 1946 as a retirement benefit for public employees in Oregon (i.e., people who work for Oregon state, county, or city government). About 900 state agencies, public schools, community colleges, and local governments (cities, counties, and special districts) participate in PERS, which covers about 95% of public employees in Oregon — more than 390,000 people.

The system gives PERS retirees a pension and an extra investment account called an Individual Account Program (IAP) account. The pension provides monthly payments for life, and the IAP provides disbursements until it is spent. For both programs, retirees have the option to take their benefits as a lump sum and save it however they choose.

To read definitions of any of the terms used on this webpage, refer to the

employer reporting quick reference, “Glossary.”

The benefits provided by PERS, the system, are decided by the Oregon Legislature. The program is funded by employer contributions, interest earned on the invested funds, and small contributions from members (only those who earn over a certain amount). The funds are collected by PERS, the agency, managed by Oregon State Treasury, and invested by the Oregon Investment Council.

Watch the video

“How Does PERS Work?” to understand how these entities work together to manage PERS.

PERS is divided into three pension plans: Tier One, Tier Two (both detailed in Oregon Revised Statute Chapter 238)

and the Oregon Public Service Retirement Plan (OPSRP) (detailed in ORS Chapter 238A). Tier One and Tier Two are both

closed to new members; all new employees are eligible to become members of OPSRP.

The plan a member is in is determined by their hire date.

Whichever plan a member is in, they remain in that plan unless they lose membership or withdraw from PERS. Even

if they retire and then return to work for a PERS-participating employer, they stay in their original plan. If

an employee moves to a different PERS-participating employer, they remain in their plan and continue to build

their benefits.

Tier One

Tier One is the oldest and most generous PERS plan. Tier One retirees receive a pension, IAP, a member account, and a

variable account (optional). Tier One retirees generally earn more benefits than Tier Two or OPSRP (see the Benefit

Component Comparisons Chart).

Tier Two

Tier Two was created by the Oregon Legislature to be less costly for employers than the Tier One plan. However, over

time, it didn’t reduce costs enough. The high cost of Tier One/Tier Two benefits means employers pay a higher

contribution rate for their Tier One and Tier Two employees than their OPSRP employees.

OPSRP

In 2003, the Oregon Legislature gave PERS a major overhaul and created a third tier, the Oregon Public Service

Retirement Plan. Over time, as more people retire under the OPSRP plan and fewer retire under Tier One/Tier Two,

employers’ PERS costs will go down.

Becoming a PERS member

To become a PERS member, an employee must complete a “trial period” of employment that satisfies these rules:

- Six months of uninterrupted service (i.e., no break in service for 30 or more consecutive working days).

- The employee is still working for the same employer at the end of the six-month period.

- The employee is still working for the same employer on the day after the six-month period ends.

Vesting

To vest their PERS membership, an employee must work for five years in a PERS-qualifying position for at least 600

hours per year. The years do not need to be consecutive, but the employee cannot have a gap in qualifying employment

of more than five years. Once a member is vested, the only way they can lose their PERS membership is if they

withdraw that membership.

All current members of Tier One and Tier Two are already vested because they have worked at least five years.

An OPSRP member becomes vested in OPSRP when one of the following occurs:

- The member completes at least 600 hours of service in each of five calendar years.

- The member reaches normal retirement age (for a list of normal retirement ages for each job class, see the

“Retirement Benefits” section in this guide).

Maintaining membership (loss of membership)

To maintain membership in PERS, an employee needs to work in a “qualifying” position (i.e., more than 600 hours/year)

and not lose nor withdraw their membership.

Membership in PERS is portable, meaning a member who leaves one PERS-participating employer to work for another

PERS-participating employer retains their membership.

Only a non-vested PERS member can lose their membership, but any non-retired member who is no longer working for a

PERS-participating employer can choose to withdraw their membership.

Tier One/Tier Two loss of membership

All Tier One and Tier Two members are vested and, therefore, cannot lose their membership.

OPSRP loss of membership

If an OPSRP employee leaves PERS-covered employment without being vested and does not return to covered employment

within five years, they will lose their PERS membership. They will receive the money in their IAP and Employee

Pension Stability Account (EPSA), but they will not receive a pension when they retire. If a person who has gone

into loss of membership enters PERS-covered employment later, they may establish a new membership after a six-month

trial period.

A PERS member is allowed to withdraw their funds and membership from their pension or IAP. If they do, however, they

give up their membership in all their PERS accounts and forfeit their future pension.

If a PERS member is no longer working for a PERS-participating employer, they do not need to withdraw. Even if they

are no longer working for a PERS-participating employer and don’t work for one the rest of their career, if they are

vested, they will still receive lifetime monthly benefit payments at retirement.

Important factors for your employee to consider when deciding whether to withdraw their member account(s):

- Oregon law requires that members who withdraw from any PERS plan withdraw from all PERS plans in which they

participate.

- If you are vested and you do not withdraw your member account(s), you will be eligible for lifetime monthly

benefit payments at retirement.

Learn more

Withdrawal information webpage

OPSRP withdrawal changes caused by Senate Bill 1049 FAQs

webpage

PERS members must reach a particular age to be eligible to retire and begin receiving their PERS retirement benefits.

The particular age is determined by:

- Their PERS plan (Tier One, Tier Two, or OPSRP).

- Their job classification (e.g., General Service, Police & Fire, School Employee). (Find a complete list in

the employer reporting quick reference, “Job Class Codes.”)

- How long they have worked for a PERS-participating employer.

Learn more

Employer reporting guide 16, "Reporting a Retirement"

Tier One/Tier Two Steps to Retire

OPSRP Steps to Retire

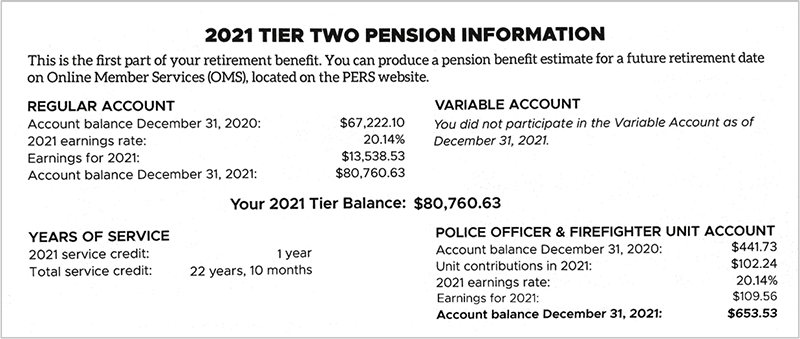

Member annual statements

Every spring, PERS mails annual statements to all active PERS members and inactive members who still have a PERS

account. The statements list the member’s service time, IAP account balance, and EPSA account balance.

Excerpt from sample member annual statement

Online Member Services (OMS) tool

PERS members can view their account information anytime using the OMS tool. You can direct members to the What Is

OMS? webpage to read what active, inactive, and retired members can do in OMS.

Divorce

When an employee gets divorced, this can affect their future PERS benefit. Advise your employees who get divorced to

send a certified copy of their divorce decree to PERS Divorce Unit along with their full name, address, daytime

telephone number, and Social Security number. They can mail or fax their request to:

Oregon PERS/Divorce Unit

PO Box 23700

Tigard OR 97281-3700

Fax: 503-598-0561

They may also want to change their beneficiary of record by completing a new Designation of Beneficiary form if their

divorce decree allows.

Death and beneficiaries

A portion of some members’ PERS benefits can be left to a beneficiary when they die. How much can be left and to whom

it can be left varies based on PERS plan, whether someone passes before or after retirement, and the beneficiary

choices they make.

Learn more

Tier One and Tier Two members

OPSRP members