Q1: What is the Benefit Equalization Fund (BEF) admin fee?

Q2: What is the Social Security fee?

Q3: What is the “wash”?

Q4: Can I download my PERS invoice into my budgeting program?

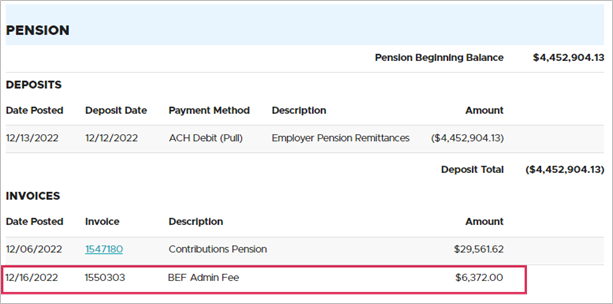

Q1: What is the Benefit Equalization Fund (BEF) admin fee?

The legislature created the BEF in 1997 as permitted by the Internal Revenue Service (IRS) to allow a full payment of

PERS retirement benefits to recipients whose benefits would otherwise be capped by Internal Revenue Code (IRC)

Section 415, which limits contributions and benefits in a tax-qualified plan. The BEF pays the amount of PERS

benefits earned by these few members (approximately 100 each year) over and above the IRS limits.

Employers who have employees who are paid from the BEF are assessed a fee to fund those benefits.

Reference ORS 238.485.

If you are an employer that is assessed a fee invoice will appear on a PERS statement between December and March.

The BEF invoice in your statement is not clickable because the invoice is manually generated outside of the PERS

reporting system. You receive the invoice by email.

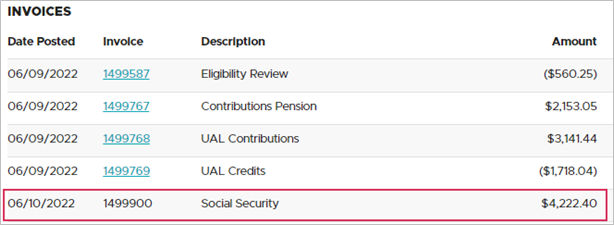

Q2: What is the Social Security fee?

Per

Oregon Revised Statute (ORS) 237.500,

Oregon public agencies must pay a fee to help cover some of the costs of administering Social Security coverage to

Section 218 employees. The contributions (charged on a

pro-rated basis to each agency) are deposited into the state’s Social Security Revolving Account and used by the

Public Employees Retirement Board to administer Social Security coverage.

The Social Security fee invoice appears in your statement between June and July each year. The invoice is not

clickable because the invoice is manually generated outside of the PERS reporting system. You receive the invoice by

email in June each year.

For more information, read

OAR

Chapter 459 Division 20, “Old-Age and Survivors Insurance” and the PERS Employers webpage Employer Invoicing,

Special Charges, “Social Security administrative fee.”

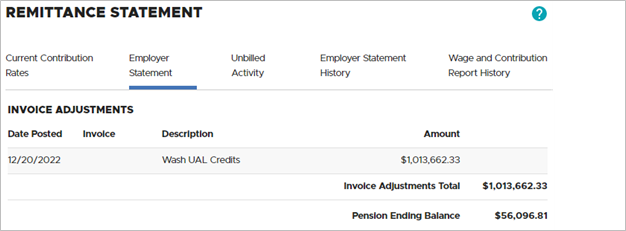

Q3: What is the “wash”?

The wash is an EDX automated batch process that occurs at the end of the calendar year. It mainly applies to

employers who have side accounts with unallocated credits at the end of the year.

In the wash, side account credits and unfunded actuarial liability (UAL) credits are zeroed out. This does not impact

PERS funds because unused credits do not represent actual cash. Side account and UAL credits are tracked separately

by PERS. Washed side account credits are zeroed out and noted on the employer statement in the form of a credit memo,

with no impact to the side account balance because these unused credits were never deducted from the side account.

Washed UAL credits are added to your employer reserve and factored into your future contribution rate.

If there is a total to wash at the end of the year, it appears as a Wash UAL Credits line item on the last statement

of the year (usually the 12/20 statement) as an invoice adjustment.

About side accounts: When you, an employer, make a lump-sum payment to prepay all or part of your

pension unfunded actuarial liability (UAL), the money is placed in a special account called a “side account.” This

account is attributed solely to the employer making the payment and is held separate from other employer reserves.

The money is invested in the

Oregon Public Employees Retirement Fund

(OPERF) and is subject to earnings and losses.

Side accounts increase an employer's actuarial assets, reducing the gap between actuarial assets and actuarial

liabilities. When liabilities exceed assets, this becomes a UAL.

Establishing a side account reduces your pension obligation, which reduces your employer contributions and rates over

time.

Learn more about side accounts, their

effect on your rate, and how to establish an account on the Employer Side Accounts webpage.

Learn more about UAL in the

Guide to Understanding Unfunded Actuarial Liability.

Q4: Can I download my PERS invoice into my budgeting program?

Yes, the functionality to download a full statement or a section of a statement was added to EDX in 2024. To learn

how it works, go to

employer

reporting guide 26,

Understanding Your Statement, section “Downloading Your Invoice.”