OPSRP Interactive Example Statement

How should I read my member annual statement?

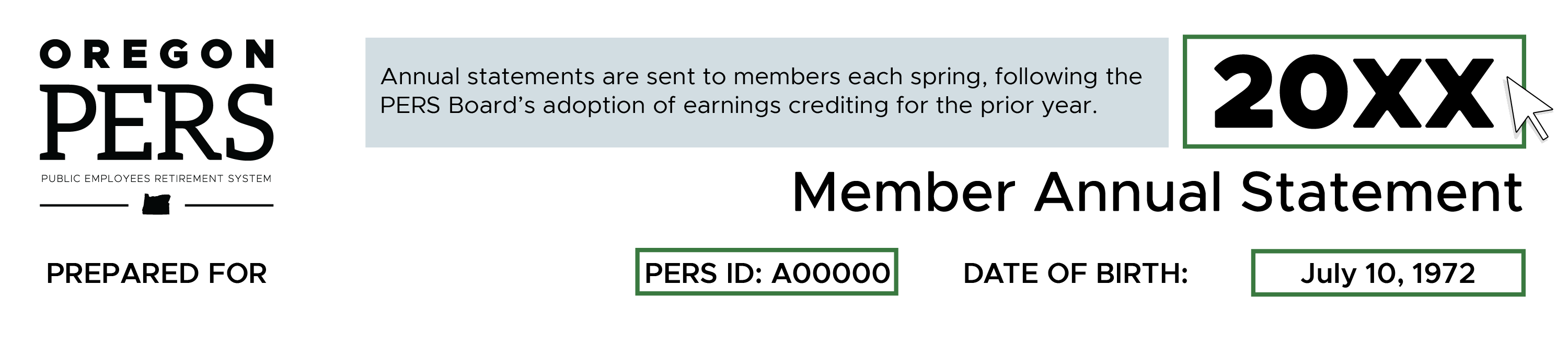

Check out the interactive example statement above. If you download and view the PDF in Adobe Acrobat, you can move

your mouse around the example and find helpful information associated with the sections highlighted (in green boxes)

on the sample statement.

Your annual statement will provide three key points of information that are important for you to check: your date of

birth, years of service, and Individual Account Program (IAP) information.

As of July 1, 2020, if your gross pay in a month exceeds the

monthly salary threshold, a portion of your 6% contributions is

redirected to the Employee Pension Stability Account (EPSA). EPSA will be used to pay for part of your future pension

benefit. As an OPSRP member, 0.75% of your 6% contributions will go into your EPSA. The remaining 5.25% will go to

your existing IAP account.

Information about your EPSA account also will be included on your statement.

What is the Oregon Public Service Retirement Plan (OPSRP)?

You are an OPSRP member if you were first hired by a

PERS-participating

employer after August 28, 2003.

OPSRP has two parts: your pension and your Individual Account

Program (IAP).

Watch a

video that explains the two parts to

your future

retirement.

Your OPSRP pension is primarily funded by your employer and can provide a

lifetime monthly benefit at retirement for eligible employees. Because your pension is a

defined benefit, this portion of your retirement does not have an account balance. Instead,

PERS uses some simple math to determine the pension you will be paid as a retiree.

To calculate your monthly pension benefit at retirement, PERS uses your salary, how long you worked for a

PERS-participating employer(s), and a percentage set by the Oregon Legislature. See more about this calculation

under the heading “How is my retirement benefit calculated?” below.

Your IAP, however, does have an account balance. You, or your employer on your behalf, make a 6% contribution*

based on your salary to your IAP. That account balance grows over time, based on the investment returns of your

IAP target-date fund.

At retirement, you can choose to receive your IAP balance in a lump sum; in equal installments spread over 5, 10,

15 or 20 years; or in

installments over your expected lifetime.

As of July 1, 2020, if your gross pay in a month exceeds the

monthly salary threshold, a portion of your 6% contributions is

redirected to the Employee Pension Stability Account (EPSA). EPSA

will be used to pay for part of your future

pension benefit. As an OPSRP member, 0.75% of your 6% contributions will go into your EPSA. The remaining 5.25%

will go to your existing IAP account.

Why do I only have an account balance listed under the IAP account information?

While OPSRP has two parts — your pension and your Individual Account Program (IAP) — your IAP is the only

account-based benefit in your retirement plan.

What “account-based” means is that contributions are deposited into an account and invested for you, over time,

to help build a pot of money for your retirement. Your PERS contributions (6% of your salary, whether paid by you

or your employer) have gone into your IAP, which is invested in a

target-date fund based on your year of

birth.

As of July 1, 2020, if your gross pay in a month exceeds the

monthly salary threshold, a portion of your 6% contributions is

redirected to the Employee Pension Stability Account (EPSA). EPSA will be used to pay for part of your future

pension benefit. As an OPSRP member, 0.75% of your 6% contributions will go into your EPSA. The remaining 5.25%

will go to your existing IAP account.

When you retire, the distribution you receive from your IAP will be based on your total account balance. You will

not receive more than this balance, whether you choose to take it in a lump sum or installments.

Factors that affect the balance you have include:

-

Changes in your salary while you are working. For example, as your salary increases over time, so too will

the amount of your contributions.

-

Investment returns, based on your

IAP target-date fund.

Meanwhile, the

pension portion of your retirement is what’s called a

defined benefit. That means the money you will receive from your pension is not set by the

balance of an individual account but rather is

defined by other means. At PERS, it is determined by a mathematical formula established by law. The

formula uses your salary, how long you worked for a PERS-participating employer(s), and a percentage set by the

Oregon Legislature. See how the calculation works under the heading “How is my retirement benefit

calculated?” below.

Because your pension is “defined” in this way, it is correct that your statement only shows a balance for your

IAP account and not one for your pension component.

What does “vested status” mean?

Vested status applies to the pension portion of your OPSRP retirement and means that you

cannot lose your right to your pension benefit

unless you withdraw from the overall OPSRP program.

One action that may trigger withdrawal from the OPSRP program and forfeiture of your pension would be

withdrawal of your Individual Account Program (IAP)

balance.

For more information about withdrawing your IAP and what forfeiture means, see the “I no longer work for a

PERS-participating employer. Can I withdraw my money?” section below.

How do I become vested?

You can become vested in your OPSRP

pension in one of two ways, whichever comes first:

1. You will need to work in a qualifying position for a PERS-participating employer for at least 600 hours per

year for five years. The years do not have to be consecutive, but there cannot be a gap in qualifying employment

of more than five years.

or

2. You are working in a qualifying position for a PERS-participating employer at any time on or after reaching

normal retirement age of 65.

Meanwhile, in your

IAP, you become vested as soon as contributions to your IAP account begin. Contributions

typically start

six months after your hire date.

How will my pension benefit be calculated?

To receive a pension benefit, you must first be vested (see the “How do I become vested?” section above)

in the OPSRP Pension Program and

eligible to retire. Your pension is a defined

benefit (see the “What is the Oregon Public Service Retirement Plan (OPSRP)?” section above) and will

provide you with a monthly income for your lifetime in retirement.

To determine what that monthly income will be, PERS uses a formula, with a percentage that varies depending on

your service type:

General service:

1.5% × years of total retirement credit × final average salary

Police and firefighters:

1.8% × years of total retirement credit × final average salary

Ultimately, the formula will result in an amount that makes up only a portion of your

final average salary at retirement. The more time you work and accrue

retirement credit in a

qualifying position, the higher that portion will be. For example:

- 30 years of retirement credit = 45% of final average salary payable as lifetime pension

- 20 years of retirement credit = 30% of final average salary payable as lifetime pension

- 10 years of retirement credit = 15% of final average salary payable as lifetime pension

Notes and definitions:

-

Your retirement credit is the amount of time (months and years) you have worked in a

PERS-qualifying position. One month of retirement credit is earned for each major fraction of a month worked.

-

A “qualifying position” is one in which you work 600 or more hours in a calendar year for a

PERS-participating employer(s). Hours worked with different participating employers are combined to determine

if the 600-hour standard has been met for a given year. Under certain circumstances, if you are not employed

for the full calendar year, you may earn retirement credit for a partial year with fewer than 600 hours of

employment.

-

Your final average salary is the greater of these amounts:

-

The average gross monthly salary that results from the three consecutive years in which you earned your

highest total salaries from one or more PERS-participating employers, even if one of those years was less

than a full calendar year.

-

1/36 of the total salary you received from one or more PERS-participating employers in the last 36 months

of active membership.

A note about overtime

House Bill (HB) 2728 (2025) requires PERS to explain to retiring members how overtime hours were used in

calculating their final average salary (FAS). This information will be included in a member’s notice of

entitlement letter (NOE), which officially tells a member what their monthly pension benefit will be.

As of January 1, 2026, NOEs must provide both of the following:

-

The total number of overtime hours the member accrued during the time period used to calculate their FAS.

AND

-

The number of overtime hours used in the FAS calculation.

For some OPSRP members, the number of overtime hours accrued may differ from the number used in the FAS

calculation. The difference may occur if the member’s actual overtime hours exceeded the average overtime hours

for that member’s job class.

How can I get a retirement benefit estimate?

You have a couple of options for getting pension benefit estimates:

1. At any time, you can generate your own estimate through

Online

Member Services (OMS). When you are viewing your “Account Summary” page, click on the “Benefit Estimate”

link in the list on the left. Click on “Create New Benefit Estimate” and follow the steps from there.

The online benefit estimator will use the most recent data supplied by your employer(s) to create an estimate for

any future retirement date. You can generate multiple benefit estimates with different retirement dates to help

you determine if you are on track to meet your retirement goals.

If your PERS account involves a divorce, you should request a written benefit estimate. OMS cannot correctly

calculate a benefit estimate on an account with a divorce award.

2. When you are within 24 months of the earliest date on which you’re eligible to retire, you can request a

PERS benefit estimate by submitting an

OPSRP Estimate Request form.

(Note: PERS processes benefit estimate requests in retirement-date order, with the earliest

retirement dates first. Estimate processing time may vary from member to member, as each account is different, so

we are unable to tell you exactly when your estimate will be completed.)

Note: Benefit estimates are just that —

estimates. They are not a guarantee of benefits.

To get an estimate for your

Individual Account Program (IAP), you can use the

IAP Balance and Installment Calculator

to

estimate your IAP distribution at retirement.

Will I have enough income for retirement?

PERS offers tools and resources you can use to estimate your income in retirement and strategize how to save more:

- Benefit estimates — Read the preceding section “How can I get a retirement benefit estimate?” if you haven’t

already.

- PERS education sessions — Attend a free workshop about your benefits. You can attend presentations at any time

during your career and repeat them as needed.

- Explore options for extra savings — Check out our Saving more for retirement webpage.

Can I choose how my IAP is invested?

Yes. As of September 2020, nonretired members are able to voluntarily make an election, once per year,

directing which

IAP target-date funds they want their funds

invested. This is called a Member Choice election.

Any eligible choice made by the annual September 30 deadline will go into effect January 1 of the following year.

For example, if you changed your TDF in September 2020, it became effective on January 1, 2021, and you will see

the change reflected on your 2021 member annual statement, which will be mailed in spring 2022.

For more information about how to change your TDF go to the

IAP target-date funds webpage.

How do I name my IAP beneficiary?

Fill out an IAP

Preretirement Designation of Beneficiary form to name someone to receive your benefits should you die

before withdrawing your account or retiring. New beneficiary designations supersede all past selections.

Do I have a beneficiary for my OPSRP pension benefit?

Before retirement

By law, beneficiary options for your OPSRP pension are limited.

If you die before retirement, PERS will only pay a death benefit to your spouse, your former

spouse under a court order (such as a divorce decree), or to any other person required to be treated like a

spouse for the purpose of retirement benefits. No other beneficiary types can be chosen

before retirement.

If you are otherwise

single and die before retirement, no pension benefits will be paid to anyone (with the exception

of former spouses under court order); you do not have a preretirement beneficiary option.

For more information, see the “Pension Death Benefits before Retirement” entry in our

Quick

Answers guide for OPSRP, under “D.”

When you apply for retirement

At the time you file your

PERS retirement

application, you can choose anyone — but

only one person — as your beneficiary, if you would like a pension option to be paid for your

lifetime and for a beneficiary’s lifetime. More information on the options are available in

Your OPSRP Pension Program and

Individual Account Program (IAP) Preretirement Guide.

I no longer work for a PERS-participating employer. Can I withdraw my account?

Yes for your Individual Account Program (IAP), if you meet certain conditions. However, due to

Senate Bill 1049, if you withdraw your IAP, this means you will

completely cancel your membership in the Oregon Public Employees Retirement System, including

forfeiting your right to a pension benefit earned as of your effective withdrawal date.

More details are available on the

Senate Bill (SB) 1049 changes and OPSRP

withdrawals webpage.

Individual Account Program

You can withdraw your IAP account balance if:

-

One full calendar month has passed since the month in which you stopped working for your last

PERS-participating employer, and you have

not worked for any other PERS-participating employer since. This includes substitute,

temporary, and on-call positions.

-

You are not eligible for PERS retirement by

age or years of service.

To request a withdrawal, you must submit a completed

OPSRP Member

Withdrawal Application Packet.

The decision to leave money in or withdraw money from your IAP account when you are no longer working for a

PERS-participating employer is

yours to make.

PERS staff cannot advise you.

Keep in mind that while you were working in a qualifying position, your IAP account received an annual

contribution of 6% of your salary (whether paid by you or your employer). As of July 1, 2020, if your gross

pay in a month exceeds the

monthly salary threshold, a portion of your 6% contributions is

redirected to the Employee Pension Stability Account (EPSA).

Once you stop working, no additional contributions are made to your accounts. The balance that remains in your

IAP account and EPSA if you have one,will continue to be credited with annual earnings or losses, depending on

investment returns. To learn about how your IAP is invested, visit

Oregon.gov/IAP.

If you withdraw your IAP account, you also will receive the balance of your EPSA.

OPSRP Pension Program

Withdrawing your IAP balance means you will

completely cancel your membership in the Oregon Public Employees Retirement System, including

forfeiting your right to a pension benefit earned as of your effective withdrawal date.

More details are available on the

Senate Bill 1049 Changes: Withdrawals

Effective July 1, 2020 webpage.

Keep in mind that:

- If you withdraw, you lose any vesting and retirement credit you had earned up to the point of withdrawal. You

will have no rights to a PERS pension benefit in retirement based on of this pre-withdrawal history.

- If you later return to work in a PERS-qualifying position, you will start over in the pension program, which

will require another six-month waiting period to re-establish membership. You will also start over in terms of

vesting (see “How do I become vested?” above).

- If you withdraw before age 59½, you may be subject to an additional income tax penalty.

If, however,

you opt not to withdraw your accounts and are vested, you will be eligible for a lifetime monthly

pension benefit at retirement and distribution of your IAP.

For more information, go to PERS’ Withdrawal

information webpage.

Why does my member annual statement say “You do not have an IAP account” under IAP information?

Your annual statement may lack IAP information for various reasons, including:

-

You previously withdrew your IAP balance, but could not cash out your OPSRP pension because it was valued at

$5,000 or more (before Senate Bill 1049 removed this option). You will continue to get statements because you

remain eligible to receive a pension benefit at retirement unless you decide to withdraw

again. However, you no longer have any balance in your IAP.

-

You did not become a PERS member in time for your first IAP contributions to post to your account and be

reflected in the current statement. Your OPSRP membership starts on the first day of the month after you finish

your six-month waiting period. So if your membership started on or after December 1 of the preceding year, the

annual statement you get in May would not include your first contributions. Those initial contributions will be

reflected in next year’s statement.

Are you age 73 or older? The IRS has requirements for you

Did you know that if you are age 73 or older, a delay in taking your retirement benefits as required by the IRS

may

result in a federal income tax penalty?

Internal Revenue Code Section 401(a)(9) requires PERS members who are age 73 or older to begin receiving their

minimum PERS benefits (i.e., required

minimum distribution) before April 1 of the year following the calendar year in

which they reach 73 or when they leave PERS employment, whichever is later.

If you are not working for a PERS-participating employer and are 73 or older, you must submit a retirement

application to PERS. We will then calculate your required minimum distribution so you can begin to receive your

retirement benefits.

If you are age 73 or getting close to it, you are advised to seek the guidance of a tax or legal professional.

Need to correct information?

Check your personal information on this annual statement to ensure it is correct.

If you are still working in a PERS-qualifying position and need to correct errors, contact your employer.

If you are an inactive or retired member, you can correct personal information using Online Member Services (OMS).

You also can submit an Information Change Request or Date of Birth Change Request form, which are available through

the Forms and publications webpage or by contacting Member Services.

Where can I get help?

Talk to PERS

Member Services can answer your questions about PERS retirement benefits from 8:30 a.m. to 5 p.m. Monday through

Friday. Call 888-320-7377 or email

customer-service.pers@pers.oregon.gov.

You also can use PERS’

Submit a Question form online.

Education sessions

PERS also offers group

education workshops that cover membership, benefits, and

retirement information. These workshops are for members at any stage in their careers and are held around the

state. Expanded workshops that include financial planning information also are available.

To learn more, go to PERS’

OPSRP education

presentations webpage.

Your employer also can request a group session to go over PERS benefits by contacting

Member Services or the

Employer Service Center.

Retirement application help

When you are within 90 days of your PERS retirement date, you can attend a

retirement application assistance

session (RAAS). This 45-minute, one-on-one appointment with a PERS staff member provides an opportunity

to have your retirement application reviewed and notarized at no cost. The staff member will answer any questions

you have about the retirement process. Be advised that PERS staff

cannot advise or counsel you about your decision to retire nor which benefit distribution options to

choose.

News and announcements

Sign up to receive

email or text alerts through

GovDelivery. You can choose the topics you wish to receive updates on,

including member news and information, education workshops, Oregon Savings Growth Plan, and PERS Health Insurance.

Go back to the main Member Annual Statement FAQ

page.

In compliance with the Americans with Disabilities Act (ADA), PERS will provide PDF documents on this page in an

alternate format upon request. To request a document in an alternate format, call 888-320-7377 (toll free) or TTY

503-603-7766.