Benjamin Franklin famously said that “an investment in knowledge pays the best interest.”

Saving to attend future education and career programs is also a smart financial choice. First and foremost, if you save beforehand, you’ll need to borrow less - and benefit from smaller student debt repayment.

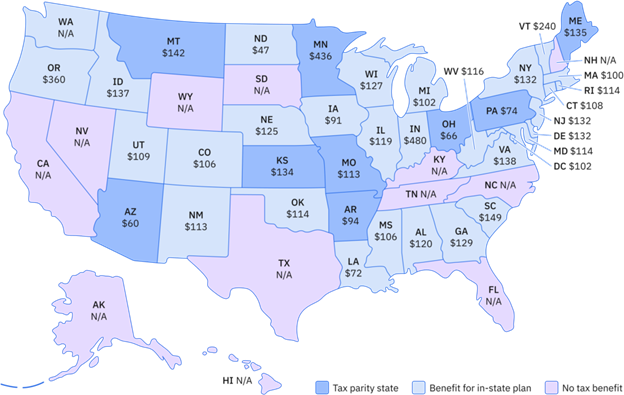

And to help put higher education and job training more in reach, the State of Oregon offers an annual refundable income tax credit that’s worth as much as $360 every year to joint filers that save in the Oregon College Savings Plan.

A new state-by-state analysis shows that Oregon incentive education saving ranks among the top 3 nationally.

In addition, because Oregon offers the incentive in the form of a refundable tax credit, it’s easier for lower- and middle-income families to save and benefit from the extra money, compared to other states.

The Oregon College Savings Plan, which is Oregon’s version of a 529 savings plan, is administered by the Oregon State Treasury.

Over time, the value of Oregon’s tax incentive adds up: Over 18 years, Oregonians could receive an astonishing $6,480.

And in addition, under federal law, all the investment gains on money saved in 529 education savings accounts are tax free when used for an expansive list of education-connected costs, inside or outside Oregon.

Benjamin Franklin would undoubtedly approve.

The research released in May from Florida-based Saving for College estimated the tax savings for couples filing jointly with $100,000 in taxable income, contributing $100/month to each of their two children’s 529 plans.

Return to article selection